![Top 15+ Sports Betting App Development Companies [Updated List]](https://media.apptunix.com/wp-content/uploads/sites/3/2025/12/30083037/banner-20.png)

Top 15+ Sports Betting App Development Companies [Updated List]

1259 Views 11 min December 20, 2025

Introducing Nalini, our tech-savvy content expert at Apptunix, with 8+ years of experience in technical content writing. With a knack for making complex ideas simple, she turns intricate tech concepts into engaging reads. Her work highlights emerging trends such as AI-powered applications, cross-platform development, digital transformation initiatives, and B2B technology solutions. Through her strategic storytelling, she plays a vital role in advancing Apptunix’s mission to shape the future of mobile and web experiences, enabling clients to make smarter, technology-driven decisions that accelerate growth and secure a competitive edge.

P2P payment apps like Venmo require essential features such as user authentication, secure digital wallets, instant peer‑to‑peer transfers, transaction histories, and social payments to enable smooth money movement.

Critical elements of development include secure backend infrastructure, compliance with financial regulations, encryption, fraud detection, and integration with banking/payment APIs for trust and reliability.

Choosing the right tech stack (e.g., cross‑platform front end like React Native/Flutter, robust backend frameworks, and secure payment gateways) ensures scalability and performance.

Development cost varies based on complexity — from a basic MVP with core features to full‑featured apps with advanced security, social features, and compliance integration.

Effective monetization strategies can include transaction fees, premium features, partnerships, and value‑added financial services to build sustainable revenue.

When was the last time you had to deal with cash? Of course, it feels like ages ago. With the advent of peer-to-peer (P2P) payment apps like Venmo, digital payments have made our lives simpler and convenient.

The Business Research Company projects that the P2P payment market size will grow from $125.94 billion in 2024 to $137.43 billion in 2025; it’s obvious why entrepreneurs and corporations want to get into this thriving industry.

If you’re a startup or established business who may want to transform financial services, creating a Venmo-like app is your chance at huge success.

This comprehensive P2P payment app development guide provides detailed steps, standout features, and the cost of creating a perfect peer-to-peer payment application.

Ready to explore the world of digital payments and develop the next game-changing financial application? Let’s go ahead and get started.

Payment apps are mobile applications that allow users to send, receive, and manage money digitally without relying on cash or physical cards. These apps connect directly with a user’s bank account, debit card, or digital wallet to make financial transactions quick and convenient.

When we talk specifically about P2P (peer-to-peer) payment apps, we mean platforms like PayPal, Venmo, Cash App, or Google Pay that let individuals transfer money directly to each other in real time. For example, splitting a dinner bill with friends, paying rent to your roommate, or sending money to family abroad can all be done instantly through a P2P payment app.

The biggest appeal of these apps lies in:

Speed: Instant or near-instant money transfers.

Convenience: No need for cash, checks, or bank visits.

Security: Encrypted and verified digital transactions.

In short, P2P payment apps have transformed how people handle everyday money exchanges, making transactions faster, easier, and more secure.

Peer-to-peer (P2P) payment apps are digital platforms that enable individuals to transfer money directly to one another without the need for intermediaries like banks or financial institutions.

These apps simplify transactions, allowing users to send and receive funds instantly using linked bank accounts, credit cards, or wallets.

With user-friendly interfaces, advanced security features, and options for splitting bills, currency conversion, or cryptocurrency payments, P2P apps like Venmo, PayPal, and Cash App have revolutionized how we handle personal and business payments in the digital age.

Let’s learn about different types of peer-to-peer payment apps:

These are dedicated platforms created exclusively for peer-to-peer money transfers, making them highly popular among users. Apps like Venmo, PayPal, and Cash App allow users to link their bank accounts, debit/credit cards, or digital wallets to send and receive money instantly. They often include features like:

Instant transfers between users

QR code payments for easy in-person transactions

Digital wallet functionality to store money within the app

These apps dominate the mobile payment app market because of their simplicity, speed, and user-friendly experience.

Social media platforms have embraced the digital payment ecosystem by integrating P2P features. For example, Facebook Messenger, WhatsApp Pay, and WeChat Pay let users transfer money directly while chatting with friends or family.

This model combines social engagement with digital payments, making money transfers feel natural and seamless. With billions of active users, social media-based apps present a massive opportunity for fintech businesses targeting younger, socially active audiences.

These apps are developed by banks or financial institutions, ensuring secure, bank-to-bank transfers. Examples include Zelle in the U.S. or bank-specific mobile apps worldwide.

Key advantages include:

Direct transfers between bank accounts (no third-party wallet needed)

Backed by bank-grade security and compliance

Higher trust among users who prefer traditional financial institutions

This type of P2P payment solution is ideal for users who value security and reliability over social features.

Mobile wallets like Google Pay, Apple Pay, and Samsung Pay also act as P2P platforms. They allow users to store cards digitally and transfer money directly from wallet to wallet. In addition to peer payments, they support:

In-store NFC payments

Online checkout options

Loyalty points integration

These apps create a broader digital payment ecosystem, making them versatile beyond just peer-to-peer transfers.

With the rise of blockchain, apps like Binance Pay, Coinbase Wallet, or Strike enable users to send and receive money in cryptocurrencies such as Bitcoin, Ethereum, or stablecoins. These apps appeal to a tech-savvy audience looking for:

Borderless, low-fee transactions

Decentralized finance (DeFi) features

Fast cross-border payments

This type of crypto P2P payment app is gaining traction, especially in international remittances and markets where traditional banking access is limited.

Let’s learn why is it worth investing in P2P payment app like Venmo:

1. Growing Popularity of Cashless TransactionsThe global peer-to-peer (P2P) payment market is projected to reach $9.87 trillion by 2030, growing at a CAGR of 19.7% from 2022 to 2030.

As digital payments gain popularity, customers are choosing rapid and simple money transfers over traditional banking methods. A banking app development company can help you capitalize on this growing demand by creating a secure and user-friendly P2P app. By investing in such a solution, you can benefit from the global shift toward a cashless society while offering seamless financial transactions to your users.

2. Expanding User Base of Millennials and Gen Z

Millennials and Gen Z dominate the user demographics for P2P apps, accounting for over 65% of digital payment users worldwide.

This tech-savvy generation prioritizes convenience and social integration, which apps like Venmo offer. By purchasing a P2P app, you can connect with a digitally active audience seeking innovative solutions for routine transactions.

3. Revenue Opportunities Through Diverse Monetization ModelsThe P2P payment industry offers a wide range of revenue-generating prospects; it’s not only about transactions. For instance, Venmo’s transaction fees alone brought in almost $900 million in 2023.

With monetization techniques such as transaction fees, premium memberships, and merchant partnerships, your P2P application can generate a sizable profit while offering customers value-added services.

Investing in P2P software such as Venmo places you at the forefront of a rapidly growing industry propelled by technological advancements and shifting consumer preferences.

Recommended: How to Build a FinTech App Like TurboTax for Easy Tax Filing and Management?

Every entrepreneurs faces this dilemma – “Which features should be included in a P2P app like Venmo?” And it’s obvious that features determine the success of any mobile application.

Below we’ve discussed must-have features for your P2P payment app, let’s learn:

1. BNPL Options“The global Buy Now Pay Later market, valued at USD 39.65 billion in 2024, is projected to grow to USD 51.74 billion in 2025 and USD 435.20 billion by 2033.”

BNPL (Buy Now, Pay Later) feature is high in demand among users as it offers payment flexibility. This feature allows users to make purchases and pay in installments, often without interest for a specific period.

Disclosed – Cost to Build a BNPL App Like Tamara

2. Social IntegrationAdding social features enhances user engagement and makes transactions more personal. Allow users to link their social media accounts, share payment updates, split bills with friends, and view transaction histories in a feed-like format. This feature not only improves user experience but also encourages organic app growth through peer recommendations.

3. Digital Wallet (E-Wallet)An integrated digital wallet streamlines transactions by allowing users to store funds directly within the app. Users can add money, link bank accounts, and manage their balance for quick payments. E-wallets also simplify refunds and reward redemptions, offering a seamless and user-friendly payment experience.

4. Unique User ID/OTPAnother feature you can consider to boost user experience and strong security is unique user ID/OTP. It is the most effective approach to enable transactions with security and also prevents unauthorized access.

5. Currency ConversionOffering currency conversion facilitate seamless international transactions. Integrate APIs for real-time currency rates and allow users to view transaction amounts in their preferred currency. Ultimately, this feature attracts global users and simplifies cross-border payments.

6. Cryptocurrency PaymentsIntegrating advanced feature like cryptocurrency payments can be beneficial for your business. Cryptocurrency payment are the digital currency like Bitcoin or Ethereum allows users to make purchases online. Make sure to integrate cryptocurrency wallets and support major digital coins with blockchain transactions tracking.

7. QR Card PaymentsQR code payments make transactions fast, secure, and convenient. Users can scan a unique QR code generated by a merchant or peer to complete payments instantly. This feature is particularly useful for in-person transactions, enhancing usability in both retail and personal contexts.

8. Rewards/ Loyalty ProgramsIncorporating rewards and loyalty programs encourages user retention by offering incentives for regular use. Users can earn points or cashback for completing transactions, referring friends, or reaching spending milestones. This gamified experience fosters loyalty and increases app engagement.

9. Security & Fraud PreventionStrong security measures are vital for any P2P app. Features like multi-factor authentication, biometric login, and AI-driven fraud detection systems protect user data and prevent unauthorized transactions. Ensuring compliance with financial regulations builds user trust and keeps your app competitive.

10. Notifications & AlertsPush notifications and alerts keep users informed about transactions, payment requests, offers, and security updates. Real-time updates ensure transparency and help users stay on top of their financial activities, making your app a reliable tool for managing payments.

11. Customer SupportRobust customer support is essential for building trust and ensuring user satisfaction.

Integrate AI-powered chatbots for instant query resolution, alongside options for live chat or email support for more complex issues.

A well-designed support system, accessible directly from the app, provides real-time assistance, enhances user experience, and minimizes frustration. With quick resolutions to user problems, your app can build a loyal and satisfied user base.

12. Social Features IntegrationSocial features like activity feeds, payment notes, and emojis make the app more interactive and user-friendly. These elements allow users to share updates, split bills socially, and personalize transactions, fostering a sense of community and boosting app engagement.

13. Request & Split PaymentsIncorporating request & split payments will allow users to split bills right in the app. It simplifies the process of group transactions like splitting bills or rent. This is a crucial feature of apps like Venmo so ensure that you at least consider adding it to your payment app.

Hire top Android or iPhone payment app developers to integrate advanced P2P Payment app features.

14. Real-Time PaymentsIntegrating real-time payments in P2P payment app like Venmo or Zelle enables instant transfers in a matter of seconds. This feature helps to eliminate delays and enhances user satisfaction.

15. P2P Transfer of FundsYou can integrate P2P financial transactions feature in your application like Venmo. It helps to make fund transfers more practical and convenient.

With this feature, users can easily send money directly to other users without intermediaries. It helps to simplify transactions and minimize transfer costs.

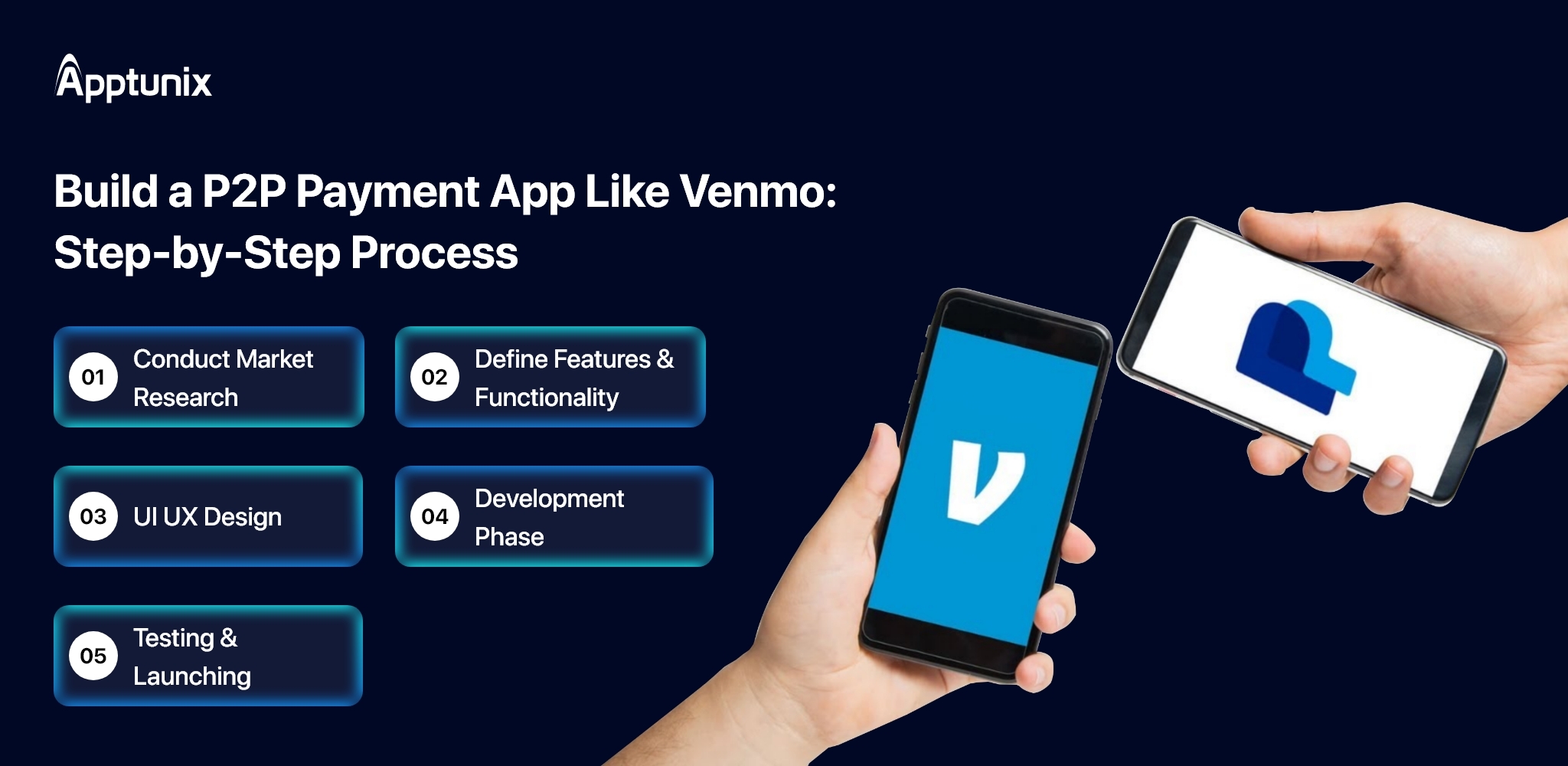

Dive into development process of P2P payment app like Venmo. Let’s understand how the overall process works:

Step 1: Conduct Market ResearchConducting market research is the primary foundation of any successful business. Here, you must focus on identifying your target audience, understanding their preferences, and analyzing competitors to pinpoint market gaps.

Make sure to research the latest trends, user behavior, and preferred payment methods, offering insights that meet user demands effectively.

Additionally, understanding regulatory requirements in your target regions ensures compliance with legal standards, setting the stage for a smooth development process.

Step 2: Define Features & FunctionalityThe next step is to define the core and advanced features your app will include. It will assess the effectiveness of your P2P payment app.

For a functional app, you must integrate core features such as user registration, instant money transfers, and digital wallets. If you want to set your business ahead from competitors – you must incorporate advanced features like BNPL options, cryptocurrency payments, and AI-driven fraud prevention.

Making a prioritized feature list helps you maintain realistic development timeframes and stay focused on providing value to users.

Read More: How to Build a Fintech App like STC Pay?

Step 3: UI UX DesignNow we’ve reached the third stage – designing your P2P payment application.

Create an intuitive, accessible, and visually appealing UI UX design. It will help users navigate through the app effortlessly. A user-friendly interface with clear layouts, seamless transitions, and consistent branding makes the app engaging and trustworthy.

During this stage, wireframing and prototyping are helpful tools for testing and improving the design before full-scale development begins.

Step 4: Development PhaseThis is the most critical phase, when your idea becomes a reality. Building the app’s frontend and backend, as well as integrating third-party APIs, are the main goals of the development stage.

Select a scalable backend framework, such as Python or Node.js, to manage transactions effectively. Cross-platform compatibility for the frontend is ensured by tools like React Native or Flutter, which let the app run smoothly on both iOS and Android.

A strong and secure app infrastructure is ensured by integrating payment gateways, notification systems, and security measures, including encryption and multi-factor authentication.

Step 5: Testing & LaunchingTo ensure it works perfectly, the software must undergo extensive testing before release. Testing includes checking for bugs, evaluating performance under high loads, and verifying the app’s compatibility across devices and operating systems.

Usability testing ensures that users find the app easy to use and intuitive, while security testing identifies vulnerabilities and confirms the robustness of your security measures.

After successful testing, the app is ready for deployment. Launch it on major platforms like the App Store and Google Play, ensuring it complies with their guidelines.

Building a peer-to-peer payment app is not just about convenience for users—it’s also a highly profitable business model. Successful apps like PayPal, Venmo, and Cash App generate millions in revenue every year through multiple monetization strategies. Here’s how to make money from payment apps:

The most common revenue stream comes from charging a small fee on transactions. For example:

Instant transfers to bank accounts usually carry a fee (e.g., 1%–3%).

International transfers often include currency conversion charges.

This model works because users are willing to pay for faster, cross-border, or high-value payments.

P2P apps often partner with businesses to process customer payments. Merchants pay a small percentage fee (usually 2–3%) on each transaction. This turns the app into more than just a money transfer app—it becomes a digital payment gateway for businesses.

When users keep money in the app’s digital wallet, companies can invest these idle funds or earn interest until the user withdraws. This is known as float revenue, and it’s a significant source of income for mobile wallet apps.

Some apps offer additional features for a fee, such as:

Advanced security options

Multi-currency support

Priority customer service

Business accounts for invoicing and bulk transfers

This freemium model attracts a wide audience while generating profits from power users.

Modern P2P payment apps are evolving into super apps by offering:

Personal loans

Credit cards

Stock and crypto trading

Buy Now, Pay Later (BNPL) services

For example, Cash App makes significant revenue from its stock and Bitcoin trading features. This diversification helps apps maximize user lifetime value (LTV).

Some apps also generate revenue by promoting partner services, cashback offers, or embedded ads. Since payment apps have rich user spending data, they can personalize ads, which advertisers are willing to pay a premium for.

When planning for app development, every entrepreneur faces the pressing question – “What exactly is the development cost of P2P payment app like Venmo?”

While there’s no one-size-fits-all answer, the cost largely depends on factors such as project complexity, UX/UI design, tech stack, features, and more. However, the estimated cost to build a P2P payment app like Venmo with basic features ranges from $15,000 to $60,000.

On the other hand, if you want to build a P2P payment app like Venmo with advanced features, it will range from $60,000 to $1,20,000 or above.

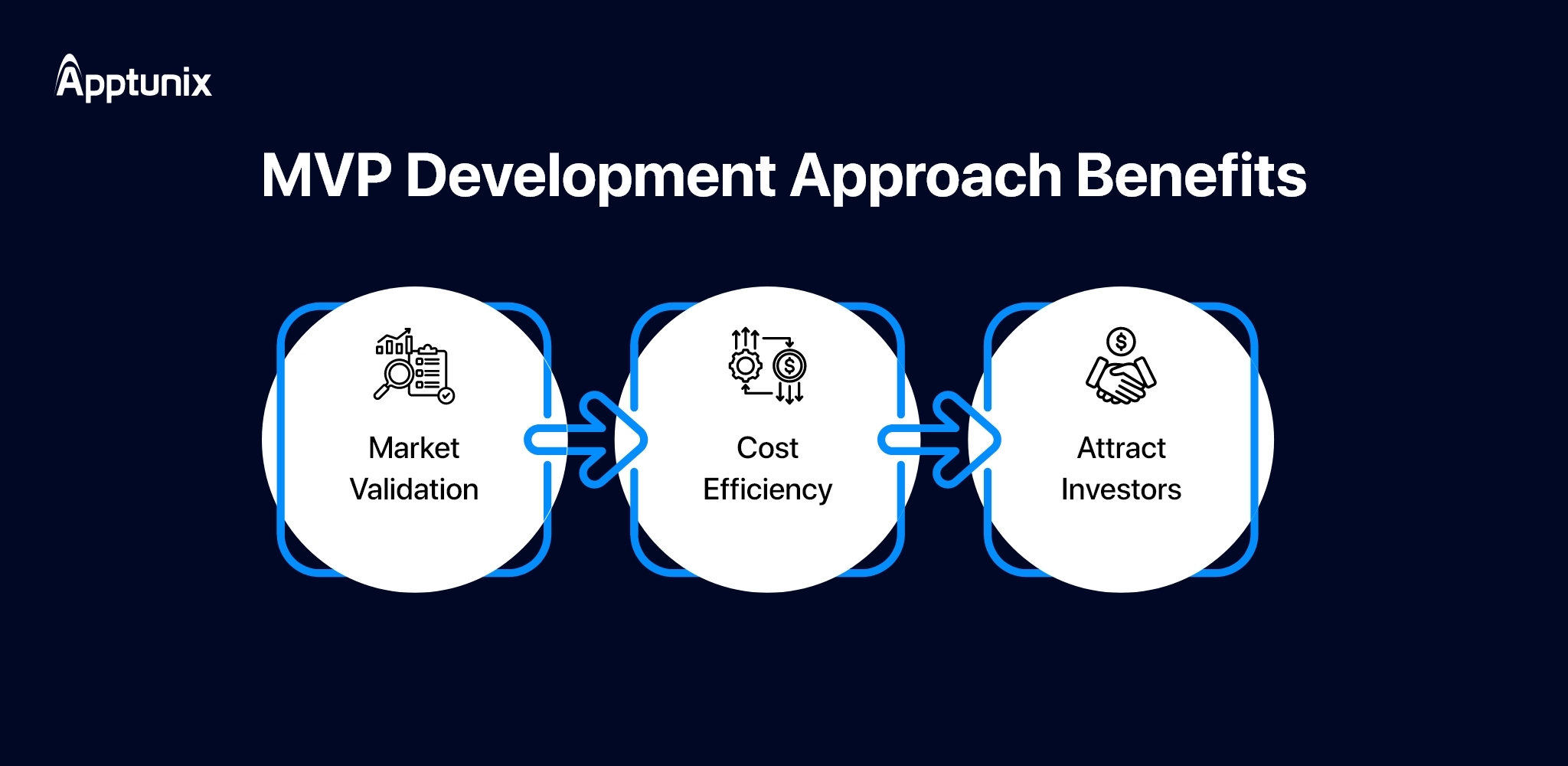

Pro Tip: Start with MVP Development Approach

If you’re looking for an cost-effective option to build P2P payment app like Venmo – you can opt for MVP (Minimum Viable Product) approach.

Here’s how MVP benefits you:

With MVP approach, you can save costs and create a solid foundation for your app’s future growth and scalability.

Bonus Read: iOS App Development Cost: Full Guide

Partner with Apptunix, a leading FinTech app development company as we specialize in developing customized, robust P2P payment solutions tailored to your unique business needs. With years of experience in app development, we ensure that your app is secure, scalable, and optimized for user engagement.

Whether you’re looking to implement advanced features like BNPL, cryptocurrency payments, or instant money transfers, Apptunix has the skills and resources to make it happen.

Why Choose Apptunix for Your P2P App?

Partner with Apptunix to bring your P2P payment app vision to life!

Q 1.How much does it cost to make an app like Venmo?

The cost to develop an app like Venmo typically ranges from $15,000 to $120,000+, depending on the app’s complexity, features, design, and the development team’s location.

Q 2.How to make a Venmo app?

To build a Venmo-like app, define its core features (e.g., P2P payments, QR codes), design a secure architecture, integrate a payment processor, and ensure regulatory compliance. Work with skilled developers to create, test, and deploy the app.

Q 3. Can I create my own payment app?

Yes, you can create a payment app by defining its purpose, integrating a secure payment gateway, ensuring regulatory compliance (e.g., PCI-DSS), and partnering with experienced developers to bring it to life.

Q 4.How to create a P2P app?

Creating a P2P app involves outlining features like money transfers and notifications, integrating secure transaction technologies, ensuring financial compliance, and hiring developers to build and launch the app.

Q 5.How long does it take to build a P2P Payment app like Venmo?

Building a P2P payment app like Venmo typically takes 3 to 6 months, depending on the app’s complexity, features, design, and the development process. Simple apps with basic features may take less time, while advanced apps with custom integrations and rigorous security measures require more development time.

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Book your free consultation with us.

Book your free consultation with us.