How Much Does It Really Cost to Build a Fitness App Like Strava in 2026?

59 Views 12 min February 24, 2026

Hardeep Singh is a seasoned B2B technical writer at Apptunix with a sharp eye for strategy and a mind wired for innovation. With over a decade of experience in technical and SEO writing, and a Master’s degree in Wireless Communication, he’s written across domains including AI, Blockchain, IoT, Cybersecurity, and beyond. At Apptunix, Hardeep drives content that bridges business goals with future-ready mobile and web solutions, thus helping startups and enterprises make smarter digital decisions.

Have you ever wondered how users split bills at restaurants without awkward math?

Ever seen friends divide travel expenses instantly inside an app?

Ever noticed how shoppers break big purchases into smaller payments during checkout?

Well, all these moments rely on one thing. A smooth split payment or BNPL (Buy Now, Pay Later ) experience backed by strong financial technology.

Businesses now want the same experience for their customers. Investors want to tap into it. Founders want to launch fast. And why not when the market is hungry for simple and flexible finance tools that make payments easier?

So, it is not wrong to say that the demand has created a massive opportunity for anyone planning a split-payment or Buy Now Pay Later product.

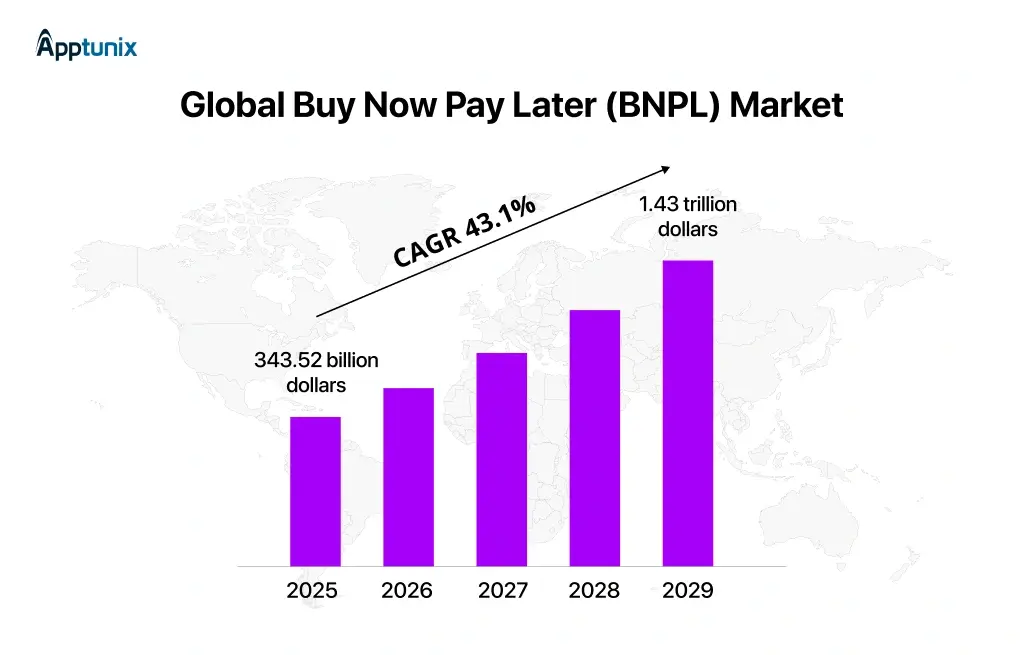

Here is the best part. The global Buy Now Pay Later market is projected to grow from about 343.52 billion dollars in 2025 to around 1.43 trillion dollars by 2029 at a CAGR of nearly 43.1%. That kind of growth changes everything. Consumers prefer flexible payments. Merchants want higher conversions. Startups look for scalable revenue models. This is exactly why more companies are investing in split payments and BNPL solutions.

Now comes the real question most founders ask.

✔ What is the actual split payments app development cost?

✔ How much does it take to build a product like Tamara?

✔ How do the features, technology, and compliance needs affect the fintech app development cost and the overall finance app development cost?

Well, if you are one among them, this guide is for you. It gives you a clear and simple breakdown. You get exact cost ranges, a transparent cost structure, factors that influence pricing, a full feature set, the development process, and monetization models. The goal is to help you understand the complete Buy Now Pay Later app development cost, or in other words, the true Shop Now Pay Later app development cost, before you begin.

Our team builds apps like these for global clients. That means you get insights based on real development work. So, let’s begin by breaking down the exact numbers so you can estimate the true cost of developing a financial technology app like Tamara.

Every founder wants one simple answer before taking the first step. How much will the complete split payments app development cost look like in real numbers? Well, the truth is that the range varies based on features, platforms, and the depth of compliance. Yet the base figures are clear when you compare different levels of complexity.

Estimated Total Cost Range: A simple BNPL or fintech app starts at $10,000 and increases as the scope grows. An app like Tamara usually sits between $30,000 and $200,000+ based on design depth, technology choices, and regulatory needs.

Here is a realistic breakdown.

A simple version covers essential bill splitting and basic payment logic.

Estimated cost: $10,000 to $30,000.

This range is ideal for founders who want to validate an idea before investing more.

This version includes user accounts, reliable payment gateway integration, stronger security, and an admin panel.

Estimated cost: $30,000 to $80,000.

This range suits startups planning to enter the market with a stable, scalable financial product.

A production-grade product covers iOS, Android, web, backend services, analytics, compliance checks, merchant dashboards, multi-region support, and powerful security layers.

Estimated cost: $80,000 to $200,000+.

This range is chosen by brands aiming for high user volume and long-term growth.

These figures help you estimate the final fintech app development cost and understand how each layer impacts the overall price. The same clarity also guides you when calculating a realistic Shop Now Pay Later app development cost or a Buy Now Pay Later app development cost.

Below is a clear view of how each development stage influences the overall budget.

| Component / Module | Approx Cost Range (USD) | Description |

|---|---|---|

| UI and UX Design (mobile and web) | $3,000 – $15,000 | Screen flows, app visuals, checkout design, onboarding |

| Frontend Development (mobile and web) | $6,000 – $30,000 | iOS, Android, responsive web app |

| Backend, Database, and APIs | $8,000 – $40,000 | Payment logic, user data, reconciliation, security layers |

| Payment Gateway or Processor Integration | $2,000 – $10,000 | Payment provider setup, split logic, testing |

| Admin Panel and Merchant Dashboard | $3,000 – $20,000 | Merchant analytics, role management, internal controls |

| Security, Compliance, Encryption | $3,000 – $25,000 | Fraud detection, data protection, KYC, or AML needs |

| QA Testing and Bug Fixes | $2,000 – $10,000 | Manual testing, automation, load testing |

| Project Management and Coordination | $2,000 – $15,000 | Planning, sprint tracking, documentation |

| Optional Features | $3,000 – $30,000 | Lending engine, credit evaluation, AI scoring, smart analytics |

Here, you must not forget that actual costs depend on region, team size, hourly rates, and compliance complexity.

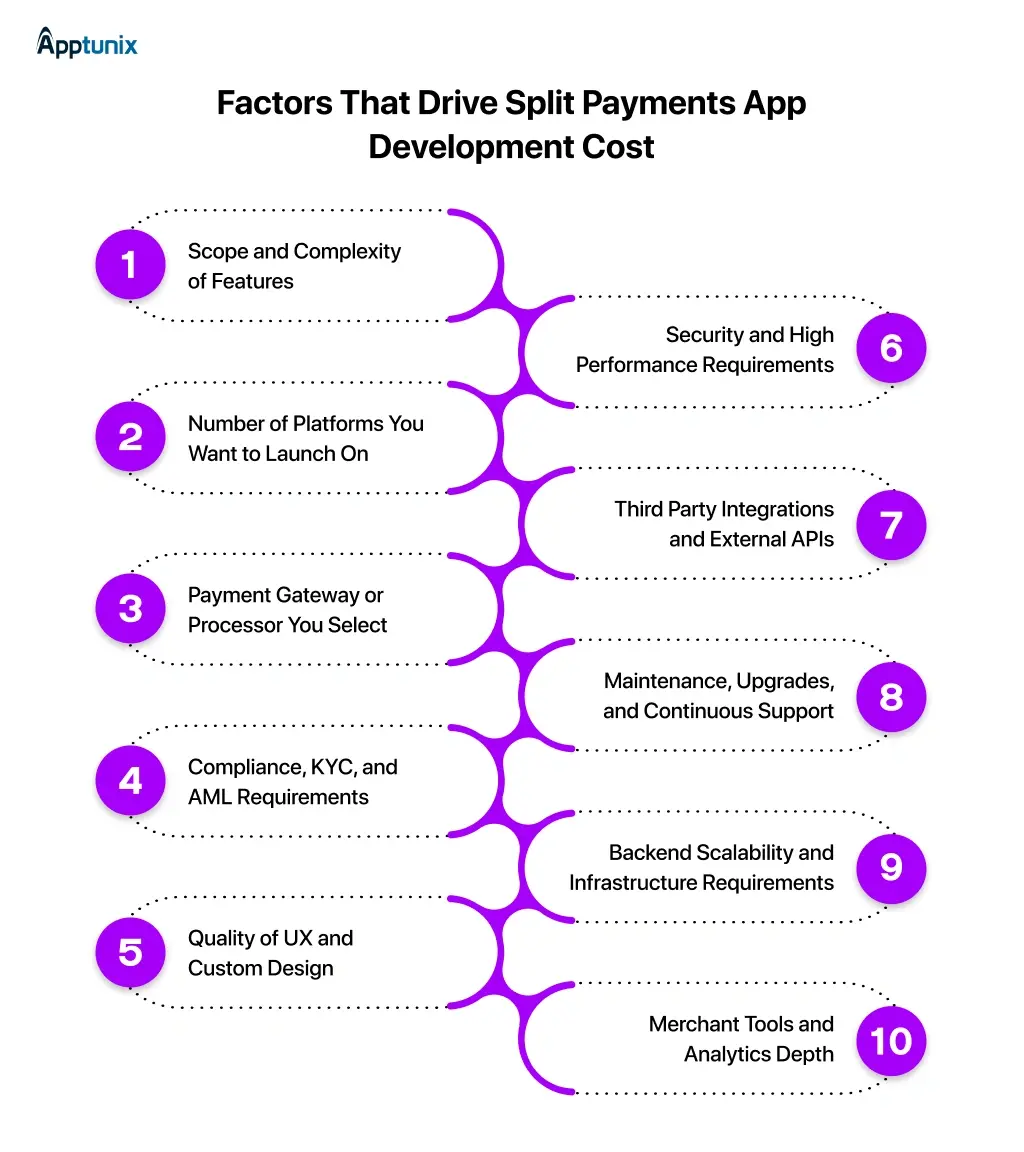

Here are the main elements that shape the final finance app development cost, or we can say influence the true cost to build a split payments app like Tamara.

1.Scope and Complexity of Features

A basic split payment flow costs far less than a full BNPL engine. Advanced features such as instalment plans, merchant management, repayment tracking, credit profiling, and automated reminders increase development effort. More screens and deeper workflows always raise the final split payments app development cost.

2.Number of Platforms You Want to Launch On

Developing only for Android costs less than building for Android, iOS, and a complete web dashboard. Multi-platform support requires more design, more coding, and more testing. This increases the overall financial technology app development cost.

3.Payment Gateway or Processor You Select

Every gateway has its own API structure, compliance rules, and integration demands. Some support split payments natively. Others need custom logic. More complex gateways raise timelines and add to the BNPL app development cost.

4.Compliance, KYC, and AML Requirements

Fintech apps must follow regional laws. KYC verification, AML checks, user risk scoring, and data privacy controls add development time. Heavy compliance regions usually increase the final Buy Now Pay Later app development cost, or the Shop Now Pay Later app development cost.

5.Quality of UX and Custom Design

Simple layouts cost less. High-end design, micro-animations, custom checkout flows, and polished dashboards require more effort. The design depth plays a major role in the full finance app development cost.

6.Security and High Performance Requirements

Finance apps handle sensitive data. Strong encryption, secure architecture, fraud-prevention tools, and stable performance under heavy traffic increase the technical workload. These layers often raise the financial technology app development cost but prevent future risks.

Recommended Read: Developing a Secure FinTech App: A CTO’s Checklist

7.Third-Party Integrations and External APIs

Many BNPL and split payment apps rely on APIs for credit scoring, user verification, fraud detection, notifications, analytics, or repayment checks. Each external service requires integration, testing, and optimization. More APIs increase the cost to make a split payment app like Tamara.

8.Maintenance, Upgrades, and Continuous Support

Apps need long-term upkeep. Updates, bug fixes, OS changes, security patches, and feature releases require regular investment. Maintenance influences the total lifecycle cost, not just the initial cost of creating a split payments app like Tamara.

9.Backend Scalability and Infrastructure Requirements

A small project may run on a simple setup. A Tamara-scale product needs microservices, advanced caching, robust load management, and cloud optimization. Large infrastructure needs increase the total cost of developing a split payments app like Tamara.

10.Merchant Tools and Analytics Depth

Many founders add merchant dashboards, settlement reports, transaction analytics, or revenue insights. These tools require complex backend logic and custom dashboards. This adds to the cost to build a fintech app like Tamara.

So, these factors define the actual cost to build a split payments app like Tamara as well as the long-term operational cost.

A standard estimate usually covers design work, app development, backend creation, QA checks, and basic integrations. That list gives you a complete starting point.

Extra expenses may include licensing fees, payment processing charges, advanced compliance, cloud operations and maintenance, analytics, and customer support. These items usually fall outside the core estimate and add to the final cost to create a BNPL app like Tamara.

Poor planning often leads to unexpected delays or reduced quality. Many teams cut critical areas such as compliance or security and end up paying more later.

A clear plan ensures you allocate enough budget to the most important parts of a financial product. Strong planning also helps you decide whether to build in-house or work with a professional team like Apptunix that handles everything end-to-end.

Last but not least, precise cost understanding helps you estimate the actual cost to develop a split payments app like Tamara before entering development.

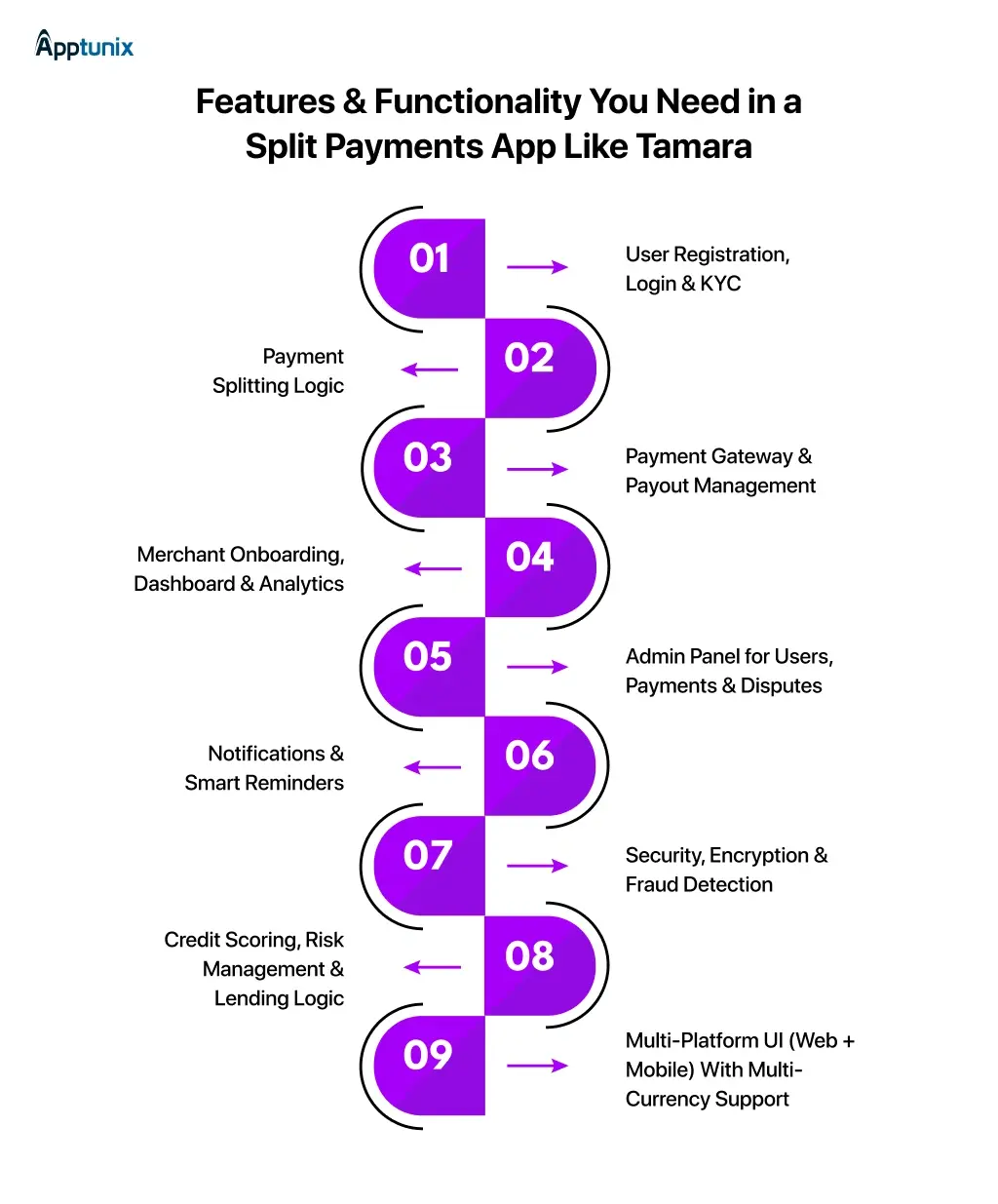

Building a high-performing Split Payments or shop now pay later app like Tamara requires much more than a simple checkout button. The success of your product depends on a carefully designed feature stack that ensures smooth payments, secure user onboarding, merchant trust, and regulatory compliance. Below are the essential features every modern split-payment platform must include.

1.User Registration, Login & KYC (If Required)

A secure onboarding flow with email/phone login, identity verification, and KYC (if mandated) ensures only legitimate users access the platform. This reduces fraud and builds merchant trust.

2.Payment Splitting Logic

The core engine of the app allows users to split payments at checkout, pay partially, or schedule installments. A robust rules engine determines how, when, and on what terms each payment is processed.

3.Payment Gateway & Payout Management

Supports real-time transactions, automatic billing, recurring payments, and merchant payouts. Seamless gateway integration ensures smooth cash flow between customers, your platform, and vendors.

Also Read: Building a Glocal Payment System: The Next Big Opportunity in FinTech

4.Merchant Onboarding, Dashboard & Analytics

Merchants get a dedicated panel to track transactions, settlement cycles, EMI usage, reminders, customer reports, and performance analytics. Faster onboarding boosts merchant adoption.

5.Admin Panel for Users, Payments & Disputes

A centralized backend to manage user accounts, transactions, verification, overdue payments, settlement cycles, penalties, refunds, and dispute resolution.

6.Notifications & Smart Reminders

Automated alerts for EMIs due, payment success or failure, plan expiry, refunds, and overdue penalties. These notifications reduce defaults and improve user engagement.

7.Security, Encryption & Fraud Detection

Bank-grade encryption, tokenization, multi-factor authentication, and fraud-scoring tools protect user data and secure financial transactions.

8.(Optional) Credit Scoring, Risk Management & Lending Logic

For BNPL models, in-built credit scoring engines evaluate risk profiles using AI or third-party APIs. This helps decide credit limits, eligibility, and dynamic repayment plans.

9.(Optional) Multi-Platform UI (Web + Mobile) With Multi-Currency Support

Allows users to access split payments across mobile apps, web dashboards, and international regions. Multi-currency support is crucial for cross-border merchants.

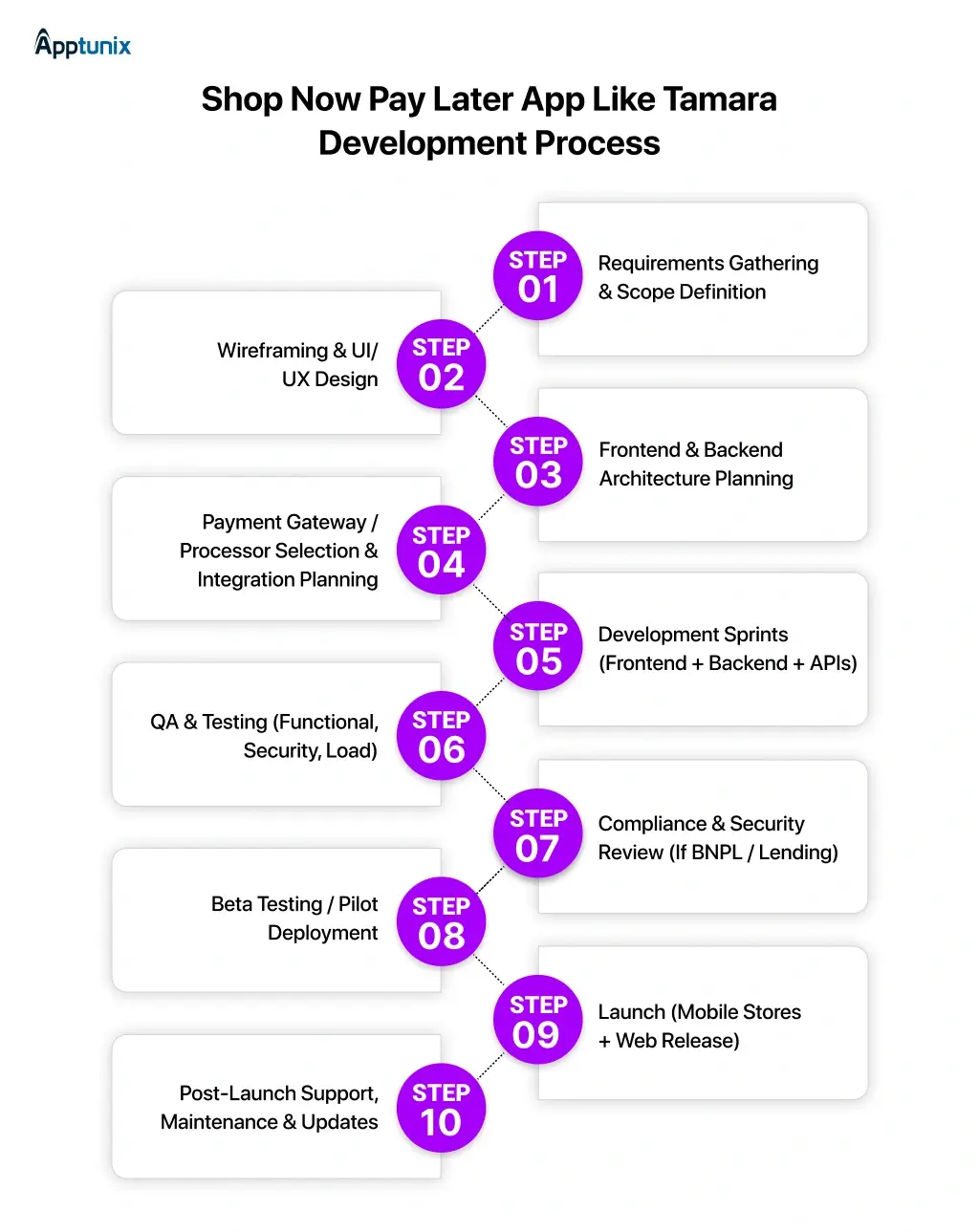

Now that you have gone through the complete cost breakdown, let’s shift gears and look at how a split-payment or BNPL product actually comes to life. A structured development roadmap ensures predictable execution, airtight security, and a polished user experience. This journey is the foundation on which every reliable fintech solution is built. Whether it’s a split payments platform like Tamara or a broader financial technology ecosystem.

This is the same roadmap followed by teams building modern BNPL systems, split-pay engines, merchant dashboards, and full-stack fintech solutions. The process ensures your fintech app development journey remains smooth, compliant, and scalable.

This is where everything starts. The team aligns on the product vision, user flows, and business goals, including:

Clear documentation at this stage sets the direction for the entire Split payments app development cycle.

Designers outline the complete user experience:

A refined UI shapes how users trust and interact with your product and becomes a key pillar in overall Finance app development success.

Next, engineers design the system backbone:

This stage ensures the platform can grow like any leading BNPL solution and sets up a clean path for Shop Now Pay Later app development, or, more accurately, Buy Now Pay Later app development at scale.

A vital engineering milestone. Here, the team finalizes:

These integrations form the core of modern BNPL app development and enable seamless checkout experiences.

Agile development begins:

Each sprint delivers usable modules, ensuring transparency and continuous progress.

A financial product cannot afford errors. Testing includes:

This ensures the platform behaves reliably under real-world financial workloads.

For BNPL platforms offering installments:

Compliance becomes a defining factor in long-term product stability.

Before launch, the app is tested with:

This phase validates usability, reliability, and merchant-side flows so your split-pay platform behaves exactly as expected.

The application goes live:

Real users now start interacting with the system.

After launch, ongoing work ensures the platform stays modern:

This cycle strengthens your BNPL app development, or, more broadly, the overall financial technology app development foundation, over time.

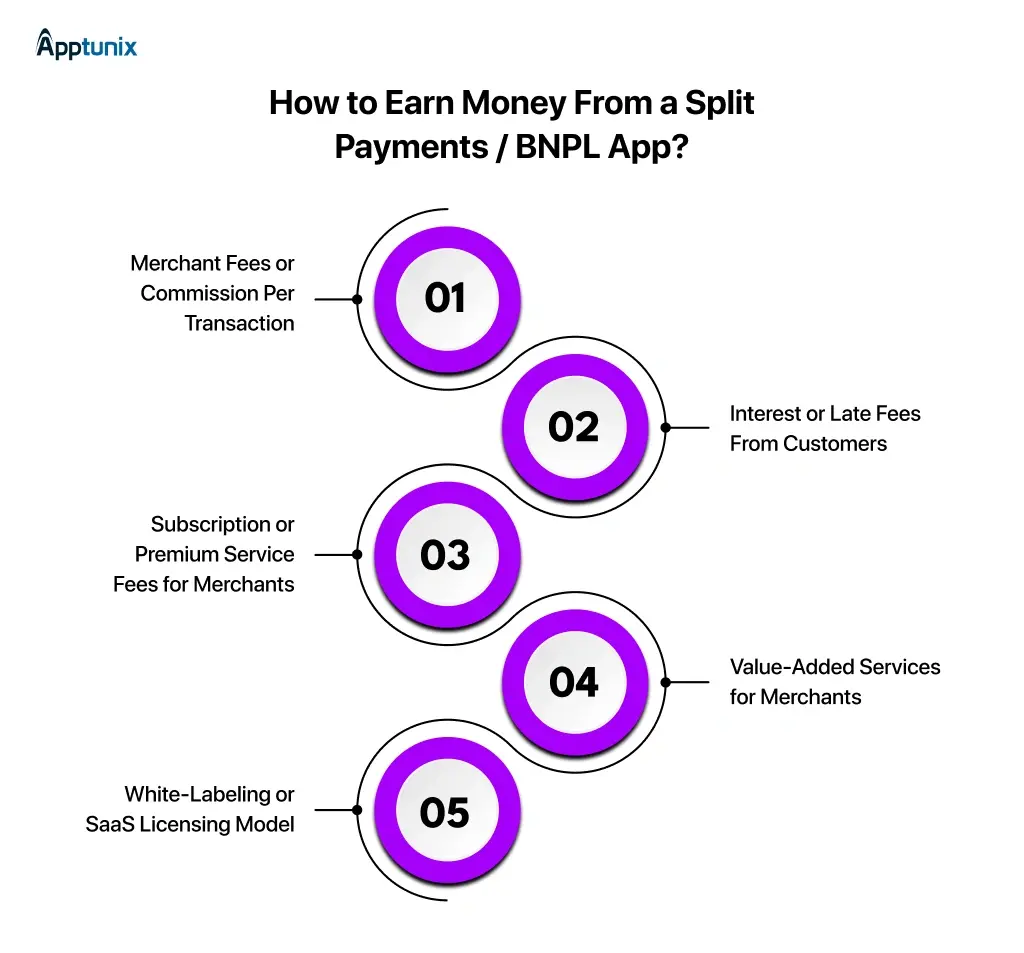

A split-payments or BNPL platform opens multiple high-value revenue streams once the product is built and ready for merchants. Modern fintech solutions like Tamara, Tabby, Afterpay, or Klarna earn through a mix of merchant-side fees, customer-side charges, analytics income, and licensing.

These monetization models are a core part of smart fintech app development or a full-scale split payments app development, since they determine long-term sustainability and scalability.

Below are the most effective monetization options for a BNPL or Shop-Now-Pay-Later platform.

Most BNPL platforms charge merchants a fixed or percentage-based commission for every successful order. This remains the primary revenue driver because merchants willingly pay for higher conversions, bigger cart sizes, and improved repeat purchases. It aligns perfectly with modern Shop Now Pay Later or Buy Now Pay Later app development strategies.

If the platform offers instalment plans or deferred payments, you can charge:

This model is commonly adopted in advanced BNPL app development, especially when the app operates like a micro-lending platform.

Merchants may pay a recurring subscription for:

These premium layers support the overall growth of your finance app development strategy while delivering consistent monthly revenue.

Extra services can significantly boost earnings. Popular value-added offerings include:

Such enhancements make your platform more attractive and strengthen the competitive position of your fintech app development ecosystem.

This model allows other businesses, startups, retailers, or banks to use your technology under their own brand. Revenue streams include:

This creates recurring revenue and extends the global footprint of your split payments, Shop Now Pay Later, or Buy Now Pay Later app development product.

Also Read: Fast-Track Your Cashback App Development Journey

Building a split-payments or BNPL app demands strong design, secure engineering, and a reliable partner. Apptunix, as an enterprise-grade fintech app development company, brings deep expertise in planning your fintech app development and delivering stable, compliant financial products.

Our team focuses on clean UX, fast performance, and a backend built for real transaction load. This approach builds trust and supports accurate decisions on accurate financial technology app development cost. You also get faster launch timelines, structured sprints, and clear communication from day one.

Support never stops after release. We handle upgrades, security improvements, compliance updates, and new features. This long-term approach strengthens your Split payments app development strategy and ensures your product grows smoothly.

If you are exploring your own finance app like Tamara, planning a BNPL app, or a split-pay solution, now is the right time. You can request a free consultation and get a tailored estimate for your Shop Now Pay Later app development cost, Buy Now Pay Later app development cost, or BNPL app development cost for free.

Your idea can scale fast. Apptunix is ready to build it, launch it, and support it end-to-end.

Q 1.What is the cost to build a Shop Now Pay Later app like Tamara?

The cost to create a Shop Now Pay Later app like Tamara typically ranges from $30,000 to $200,000+, depending on features like EMI setup, credit checks, and merchant onboarding.

Q 2.How much does it cost to develop a BNPL app like Tamara?

The cost to build a BNPL app like Tamara usually falls between $30,000 and $200,000+, influenced by KYC/AML integration, repayment automation, and fraud detection.

Q 3.What is the cost to create a fintech app like Tamara with basic BNPL features?

The cost to develop a fintech app like Tamara typically ranges between $30,000 to $50,000+, covering user apps, merchant portal, admin panel, and secure payment flows.

Q 4.How much does it cost to make a BNPL app like Tamara for multiple regions?

If you want to make a BNPL app like Tamara for the UAE, KSA, and global markets, expect $40,000 to $100,000+, depending on compliance, multi-currency support, and local gateway integrations.

Q 5.What is the cost to build a fintech app like Tamara with AI-driven risk scoring?

Building a fintech app like Tamara with AI scoring costs $40,000 to $120,000+, based on the complexity of the algorithms and third-party data sources.

Q 6.What impacts the cost to develop a Shop Now Pay Later app like Tamara?

The cost to develop a Shop Now Pay Later app like Tamara varies, depending on EMI engine complexity, dashboards, user journey design, and compliance modules.

Q 7.Is the cost to create a BNPL app like Tamara higher if merchant dashboards are included?

Yes. With deep analytics dashboards, the cost to create a BNPL app like Tamara increases to $40,000 to $120,000+, depending on API layers and reporting depth.

Q 8.What is the cost to make a fintech app like Tamara with multiple payment methods?

A fintech app with Cards, Apple Pay, Google Pay, STC Pay, and wallets typically costs $45,000 to $100,000+, depending on the number of payment partners.

Q 9.What is the ideal budget for startups looking to build a Shop Now Pay Later app like Tamara?

Startups generally need $30,000 to $50,000+ for a feature-rich MVP of a Shop Now Pay Later app like Tamara, covering essential flows without advanced automation.

Q 10.What is the long-term maintenance cost after developing a BNPL or fintech app like Tamara?

Post-launch maintenance for a BNPL/fintech app like Tamara typically costs $1,500 to $6,000 per month, including hosting, monitoring, updates, and feature enhancements.

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Book your free consultation with us.

Book your free consultation with us.