Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

Robinhood Stock Trading App: Business Model of Silicon Valley’s Hottest Startup Revealed

Table of contents

Robinhood stock trading app is indeed a business like no other – its success story is worth telling and the way it has disrupted the stock trading market is not just exciting but inspiring for many entrepreneurs around the world.

At the time when Robinhood was launched in the year 2013, just a few people believed that it would make an impact on the market. However, today, after the company’s recent fundraising of more than $200 Million at a valuation of around $8 Billion, we got the proof that it has entirely disrupted the fintech market.

If you are an entrepreneur – planning to go for Fintech app development and make it big in the $124.3 Billion strong Fintech Market – this blog is for you. Before you start your own venture, you must know the strategies of already established players in the market to stand out.

Therefore, to give you a clear picture of how the Robinhood stock trading app works, we have broken its strategic business model into small segments. Now let’s dig deeper into all of them:

Robinhood Stats and Facts: Valuation and Other Milestones

- Founders: Baiju Bhatt, Vlad Tenev

- Launched In: 2013

- Headquarters: Menlo Park, CA

- Number of App Users: More Than 10 Million

- Company Valuation: Approx. $11 Billion

- Total Funding Amount: $1.7 Billion

The number 1 trading app Robinhood’s glorious path to $11 Billion says all about the interest of investors in the Fintech Market. Despite the chaos created by the COVID-19 pandemic, the Robinhood stock trading app has raised more than $200 Million this week. This new funding round valued the app at $11 Billion, up by nearly one-third of its valuation just one month ago after the previous funding round.

Also, this latest fundraising is leading to speculation that the app, which has altogether disrupted the business of stock trading in the USA since its launch in 2015, is planning to sell its shares to the public. However, an official statement on the same is yet to come.

As per the Robinhood team, its latest funding amount would go towards building its core product and improving the app’s customer experience. Since its launch, the company has been completely used-centric and that is one of the reasons behind its immense success.

Let’s now move forward and see how the Robinhood stock trading app came into the picture, how it works and brings money to the table to learn a few lessons from its success.

Robinhood’s Inspiring Story: The Climax of 2008 Financial Crisis

It is hard to believe but the inspiration behind Robinhood Stock Trading App was the financial crisis of 2008 – that the world has still not forgotten. During that time, a lot of people went into panic mode, not knowing what is exactly happening in the financial sector.

Seeing the situation and problems created by the crisis – two like-minded individuals conceived the idea of creating a mobile-first no-commission stock trading mobile app. They observed how the crisis led to the fast global growth of algorithmic stock trading and the entire market was also going electronic at that time.

The duo found this opportunity very exciting and they started working on developing their own trading firm in the midst of a crisis. Finally, they launched a website for Robinhood in December 2013, and within 30 minutes after the launch, they got their first user, and then users started increasing. The next day, they found that the number of users spiked to 400 in just a single day.

They always operated using a user-centric approach and never forgot to optimize the experience their product was offering. They launched their mobile app in March 2015 and soon after just three years, in February 2018, the app served 3 Million accounts (equivalent to well-established online broker E-Trade).

After that point, their funding game started and that’s how the startup reached new heights:

- March 2015 – Robinhood Stock Trading App Was Launched

- April 2017 – It Raised $110 Million At a $1.3 Billion Valuation

- May 2018 – The App Closed a $363 Million Series D Round

- May 2020 – It Raised $280 Million in Venture Funding

- August 2020 – Robinhood Raised $200 Million in Series G Round

The Robinhood Stock Trading App has raised a total of $1.7 Billion in funding and it is still growing. If you are inspired by the success of this app and want to invest in building your app now – the situation is in your favor.

A few people will call starting a business in the midst of a crisis, a flop move – however, it’s not just Robinhood founders that made it a hit one. Have a look at these Five Iconic Mobile Apps That Were Launched During a Recession.

Let’s now move forward and see how Robinhood stock trading works:

The Business Model of Robinhood Stock Trading App

Robinhood stock trading app makes it simple for users to buy or sell stocks on mobile. A user can do everything by downloading the Robinhood mobile app – from the initial sign-up to buying stocks in just a single tap. They just need to provide some personal information – like this process goes with any other brokerage and after that, the entire process becomes as easy as a walk in the park.

It is one of the best stock trading apps in the market today. The Robinhood features revolve around tracking the stocks users own, searching for the same, trading, finding order status, etc. The app has two versions, free and paid. While using the free version, users can access stocks, ETFs, and Bitcoin, the paid one lets them invest in and out of mutual funds.

Here is all you need to know about its entire Robinhood business model:

- The Robinhood app started to eliminate the gap between professional stockbrokers and individuals with no prior experience in investment. Therefore, its major target audience is millennials who have an interest in stock trading.

- The app’s major value proposition lies in the commission-free selling and buying of stocks. Users are allowed to trade instantly for free after they create an account in the app. Using the app, they can also earn money with their uninvested cash and competitive APY with an account.

- A user’s dashboard provides all the information that an investor should know before investing – like real-time market data, news, order status, balance, and so on.

- Using the app’s trading tools, a user can access all the required information easily and the app also sends notifications about important events to manage portfolios in a better way.

- Along with helping users invest in stocks, funds, and options, the app also lets them buy and sell cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), and Bitcoin (BTC) with Robinhood crypto.

- The way how Robinhood stock trading app makes money is completely logical and ethical. It doesn’t sell user’s data to earn money like other apps. It makes money using three monetization methods – Interests, Premium Subscriptions, Margin Interest and securities Loans, Stock Loans, and income generated from cash (we’ll discuss the revenue model later in this article).

- Another reason behind Robinhood’s strategy is to manage expenses. They control costs with the help of technology. The company has less than 200 employees and they don’t spend on things like marketing and customer support.

All in all, we can say that Robinhood is an app to make your money work for you. It provides trading tools, news related to finance, and various products for cash management to deal with cash and trading in an easy and hassle-free manner.

After seeing all these details, you must be wondering how much will it cost to develop a stock tracking app like Robinhood. To get a ballpark estimate on the same – you can head to our blog on Robinhood Like App Development Cost.

Now that we know how Robinhood stock trading app works – let’s find how the app makes money by putting some spotlight on its revenue model.

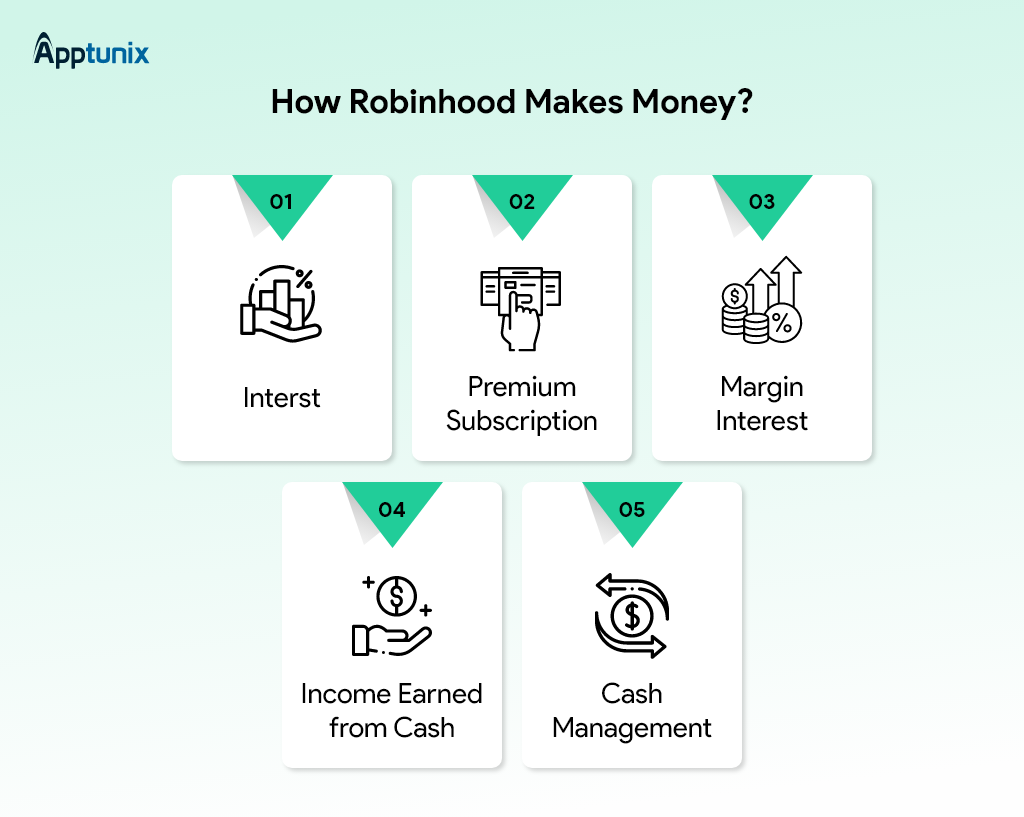

How Does Robinhood Trading App Make Money?

Robinhood trading app operates using the freemium business model with an addition of some other revenue sources. Let’s see an elaborated analysis of the Robinhood revenue model to see how it makes money even when trading is commission-free on its platform:

1. Revenue from Interest

Robinhood charges interest on uninvested cash deposited in interest-bearing accounts outside the sweep service. This is one of its major sources of revenue.

So, suppose a user has $1000 in his account and the present interest rates are around three percent. The app would get $30 for having his money sitting in their account per year. This small amount doesn’t look like a big deal.

However, if we multiply it with accounts in Millions – we can get an idea of how much money the Robinhood stock trading app is making this way. They are making tons of money as the interest rates and the number of accounts on the app – are both on the rise.

2. Premium Subscriptions: Robinhood Gold

The app’s premium subscription called Robinhood Gold is its major source of revenue.

This service is basically for experienced investors who want to make big investments in the stock market. By purchasing this membership plan, users can get additional buying power and extended trading hours. It also lets them borrow money to buy stocks and ETFs. Users also don’t have to wait for three days to use their money for trading using this plan.

To become a member of Robinhood Gold, a premium account membership program, users must pay $5 each month. Also, the costs for Robinhood Gold account for less than 10% of Robinhood’s overall earnings.

3. Margin Interest & Securities Loans

Robinhood also lets you buy stocks on margin. In simple words, it lets you borrow money to increase the amount of potential earnings you will make when a stock goes up. For example, 10% of $2000 is more than 10% of $1000. So the app lets you borrow money to increase your earnings on a particular stock.

However, you will have to have at least $2,000 in your account to buy on margin. This is a bit risky approach for users as in case of a bad bet they can lose more than what they have invested. In any case, they’ll have to pay back the principal they borrowed.

By lending securities to counterparties, Robinhood also generates income. These two types of interest represent about 17.5% of the total revenue of the company, which goes to Robinhood.

4. Income Earned from Cash

Robinhood makes money on uninvested cash by transferring it into interest-bearing bank accounts like all financial companies.

5. Cash Management

Debit cards are made available to consumers by Robinhood through its Spending Account program, formerly known as the Cash Management program.

Robinhood generates a small profit through interchange fees, which are effectively transaction processing fees charged by card issuers when clients use their debit cards to make transactions.

The business provides a debit card along with a brokerage account from Robinhood Financial LLC, a SIPC and FINRA member. Sutton Bank, which issues the card under a Mastercard license, pays the interchange fee to Robinhood. Program banks also cover the fees associated with sending money to them through fintech.

Stock Trading App Development: How Apptunix Can Help You Develop a Successful App Like Robinhood?

The trading applications have been fulfilling the needs of a diverse generation and the entrepreneurs owning the trading applications altogether. Make sure you have great assistance on your side if you want to develop a successful stock trading software like Robinhood.

Apptunix, the top leading fintech app development company takes care of that for you. You may be confident that your endeavor will be a tremendous success if you have skilled team members such as programmers, developers, and other team members.

It’s a Wrap

Robinhood stock trading app is very attractive for users as it is easy to use and lets them trade for free. Also, the app’s business and revenue model are quite impressive because investors always invest huge amounts of money in this app which leads to the app’s success.

If you too want to make an app that works like this – pay heed to the Robinhood Business Model and try implementing the same strategies for your app with a unique approach. Get in touch with the FinTech application development company that can assist you at every step of your journey. With all of that seen and analyzed, let’s now wrap things up. Wish you all the very best for your app idea!

Frequently Asked Questions(FAQs)

Q 1.Can I make money using the Robinhood stock trading app?

Your investing gains could be swiftly erased by things like fees and expenses, but using Robinhood has the advantage of having low fees and charges. The value of your investment, however, is more influenced by the investment itself than by the brokerage house you choose to hold your shares with. Additionally, it is influenced by more general economic factors like stock market activity.

Q 2.Is Robinhood a safe app?

Robinhood is a cryptocurrency and stock exchange that is incredibly secure both for investors and users. It is a member of the Securities Investor Protection Corporation or SIPC. This indicates that, in the event of failure, the broker will be able to safeguard your funds up to $500,000. Keep in mind that this insurance only applies to broker failure and does not cover losses sustained through investment operations.

Additionally, Robinhood has numerous security measures to protect users’ assets, including insurance, robust security, two-factor authentication (2FA), penetration testing, and protection from cyberattacks.

Q 3.Would Robinhood be a good broker for beginners?

Robinhood is a suitable fit for novice investors. The software has a very low pricing point, which is typically preferred by novice investors, as well as a basic, easy-to-use trading interface. The fundamental goal of Robinhood is to make it simple to access the stock and cryptocurrency markets.

Rate this article!

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Humane yet subtle, Naiya is a girl full of ideas about almost everything. After earning a bachelor’s degree in computer science and engineering, she decided to merge her technical knowledge with her passion for writing – to accomplish something interesting with the fusion. Her write-ups are usually based on technology, mobile apps, and mobile development platforms to help people utilize the mobile world in an efficient way. Besides writing, you can find her making dance videos on Bollywood songs in a corner.

App Monetization Strategies: How to Make Money From an App?

Your app can draw revenue in many ways. All you need to figure out is suitable strategies that best fit your content, your audience, and your needs. This eGuide will put light on the same.

Download Now!