Wedding/Marriage App Development for KSA and GCC: A Founder’s Playbook

153 Views 12 min December 26, 2025

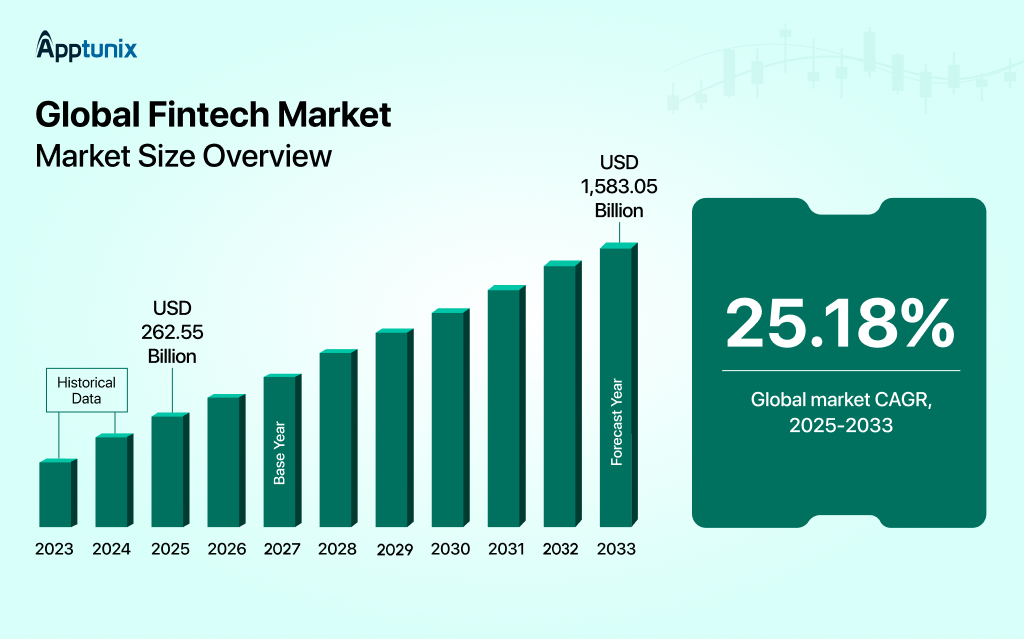

Money is moving faster than ever and so is the technology behind it. From digital payments to AI-driven lending, fintech is quietly rewriting how the world handles finance. Analysts predict the industry will pass $300 billion by 2030, and it’s not slowing down anytime soon. The companies investing in fintech today are setting the foundation for how banking, insurance, and payments will look for the next decade.

Yet, here’s the part most people don’t talk about: nearly 70% of fintech startups never make it past the launch stage. The reason is choosing the wrong development partner. A single mistake in tech architecture, compliance, or scalability can derail months of effort.

So how do you avoid becoming part of that statistic? This guide will help you find the top fintech software development companies. We’ll uncover why fintech continues to be one of the most profitable sectors, what options you have for building your product, and how to plan your fintech app development budget the smart way.

Ten years ago, fintech was considered a niche. Today, it’s a global powerhouse shaping the way individuals and businesses handle financial transactions.

Startups are racing ahead with AI-powered analytics tools, neobanking apps, and blockchain wallets, all built through custom fintech app development. Meanwhile, larger enterprises are using these technologies to automate customer journeys, cut operational costs, and increase adoption rates across digital channels.

Behind every successful fintech product is a skilled team of iOS and Android developers. The best fintech app developers for enterprises focus on scalability, data security, and compliance, ensuring systems can grow with demand. For startups, partnering with an experienced fintech mobile app development company often makes the difference between an idea that fades and a product that thrives in the market.

When entering fintech, businesses face one of the most critical decisions: build a custom fintech app or use a ready-made solution.

Expert Insight:

If you’re a startup, using an off-the-shelf fintech solution might seem like the smart move. It’s affordable, fast to deploy, and easy to test with early users. But as your audience grows, you’ll likely run into roadblocks. Limited scalability, restricted features, and customization issues often lead to an expensive rebuild later.

That’s where partnering with experienced fintech software development companies makes all the difference. They build solutions that grow with your business. For enterprises, custom fintech app development offers stronger compliance frameworks, advanced security, and enterprise-grade scalability.

Here’s a Complete Guide To Fintech App Development Process

Budgeting is often the biggest hurdle for businesses entering the fintech space. Go in blind, and you risk overspending, under-delivering, or launching a product that doesn’t align with your business model.

A realistic estimate of fintech app development costs depends on multiple factors, including features, complexity, platform, and integrations. Costs can start as low as $15,000 for a simple MVP but climb to $100,000+ for enterprise-grade platforms with AI and blockchain features.

Here are the key factors that drive cost:

A simple digital wallet costs significantly less than an enterprise-grade banking app. Advanced solutions that include AI-powered fintech analytics, blockchain-based verification, and multi-currency support need more development hours and expertise.

Building for iOS, Android, or both will affect costs. While cross-platform frameworks cut time, they may introduce performance or customization limitations.

Features like AI-driven fraud detection, predictive analytics, or blockchain-ledger verification increase development costs but deliver stronger ROI through security, automation, and smarter decision-making.

Also Read: AI in Blockchain

Fintech adoption depends on trust and usability. Custom dashboards, intuitive flows, and personalized user journeys enhance adoption but also add design and development hours.

Fintech apps are not one-and-done projects. Ongoing compliance updates, security patches, and performance upgrades are critical. Skipping this step can lead to costly breaches and regulatory penalties.

The companies listed below are recognized globally as leaders in fintech app development services. They combine industry knowledge with advanced technical expertise, helping startups and enterprises build apps like TurboTax that redefine the financial services landscape.

1. Apptunix

Apptunix is a globally recognized and award-winning fintech app development company that delivers secure, scalable, and compliant solutions for startups and enterprises alike. Their expertise spans digital banking apps, insurance platforms, cryptocurrency applications, and payment solutions. Known for their rigorous approach to compliance and data security, Apptunix offers end-to-end fintech app development services that help businesses scale with confidence and maintain a competitive edge.

2. Quickworks

Quickworks has over a decade of experience delivering fintech app development services and on-demand solutions. They stand out for their emphasis on quick deployment without sacrificing performance, scalability, or security—making them an ideal choice for fast-growing startups. Quickworks is trusted by businesses looking to enter the fintech space quickly while maintaining future readiness for expansion and compliance.

3. 10Pearls

10Pearls is consistently ranked among the best fintech app development companies due to their innovative use of AI, blockchain, and design thinking. Their team specializes in creating secure, scalable, and user-friendly fintech platforms for enterprises around the globe. From digital banking and trading platforms to blockchain-based apps, 10Pearls helps businesses modernize financial services with cutting-edge technology.

4. Clarion Technologies

Clarion Technologies provides custom fintech app development services tailored to startups and enterprises that require compliance-driven, scalable, and high-performance financial solutions. Their approach emphasizes security and adaptability, enabling businesses to stay ahead in the evolving financial sector. Clarion’s portfolio includes mobile banking apps, lending platforms, and secure payment solutions.

5. Zco Corporation

Zco Corporation has established itself as a leading fintech mobile app development company, known for building robust and secure financial solutions. They specialize in digital wallets, payment solutions, and mobile banking platforms that prioritize both scalability and compliance. With expertise in blockchain-based fintech app development, Zco delivers future-ready financial technology tailored to business needs.

6. Y Media Labs

Y Media Labs partners with leading global brands to drive financial innovation through AI-powered fintech app development. Their focus is on building personalized financial platforms, mobile banking apps, and secure payment solutions. Recognized for their design-first approach, Y Media Labs helps businesses create financial products that combine compliance with exceptional user experience.

7. WillowTree

WillowTree is well-known for its custom fintech app development services, with a strong emphasis on user experience and performance. They provide comprehensive support across the fintech lifecycle, from strategy and design to deployment and maintenance. Their expertise covers secure payment platforms, AI-powered analytics, and enterprise-grade banking solutions.

8. Prismetric

Prismetric is a full-service fintech app development company specializing in mobile banking, digital wallets, and blockchain-driven payment systems. Known for their reliability and on-time delivery, Prismetric helps both startups and enterprises implement secure and scalable financial solutions. Their focus on speed and compliance makes them a trusted partner in the global fintech space.

9. Cumulations Technologies

Cumulations Technologies develops AI-powered fintech apps that are secure, scalable, and performance-driven. Their expertise includes building custom fintech solutions for startups and enterprises, with integrations ranging from blockchain to predictive analytics. Businesses partner with Cumulations for fintech innovation that balances compliance with next-level customer experience.

10. Matellio Inc.

Matellio Inc. delivers end-to-end fintech app development services, from mobile banking platforms to trading and payment apps. Their custom solutions are built with scalability, compliance, and user experience in mind. Known for their enterprise-grade expertise, Matellio combines custom fintech app development with innovative features like AI-driven analytics and blockchain verification.

Hiring the right developers can define your fintech app’s future. The best fintech app developers for enterprises understand not just code, but also compliance, security, and user behavior. One wrong hire can set your project back with delays, unexpected costs, or security vulnerabilities. Here’s how to make smart choices from the start.

Don’t stop at surface-level credentials. Review portfolios to see if the team has real experience in banking app development, fintech app development for startups, or blockchain-based fintech projects. Look for signs of scalability, secure architecture, and user-friendly design. The best teams showcase apps that perform under high traffic and meet financial compliance standards.

Modern fintech apps rely on technologies like AI, data analytics, and secure APIs. Your developers should be fluent in frameworks that support AI-powered fintech app development and mobile platforms like iOS and Android. If your vision includes predictive analytics or fraud detection, make sure the team has hands-on experience building similar systems.

Fintech isn’t like other industries. It’s heavily regulated and requires developers who understand compliance laws, data privacy, and payment security. Partnering with experienced fintech software development companies ensures your app is built with the right safeguards in place and passes audits without major fixes later.

Building an app is only the first phase. Continuous maintenance keeps it secure and functional. Choose a fintech mobile app development company that offers long-term support, including version updates, security patches, and new feature integrations. This prevents small issues from turning into expensive setbacks.

Even the best developers can fail if communication isn’t clear. Look for a team that provides regular updates, sets realistic timelines, and explains technical decisions in plain language. Misalignment here often leads to budget overruns or missed launch windows. A partner who values transparency can save you both time and stress.

Startups that incorporate these trends into their fintech apps gain a competitive advantage, while enterprises enhance operational efficiency and customer satisfaction. Partnering with top fintech software development companies ensures these technologies are implemented correctly and strategically.

Fintech apps today rely on advanced technologies to provide secure, intelligent, and scalable financial services. Startups and enterprises that adopt the right tech can improve operational efficiency, enhance customer experience, and stay ahead of the competition.

Here are the seven most important technologies in modern fintech:

1. AI-Powered Fintech App DevelopmentOverview: AI automates routine tasks, delivers predictive analytics, and powers personalized financial recommendations.

Use cases: AI chatbots, credit scoring, fraud detection, personalized investment advice.

Impact: 65% of new fintech apps use AI to enhance decision-making, improve customer experience, and reduce operational costs.

2. Blockchain TechnologyOverview: Blockchain ensures secure, transparent, and immutable transactions, crucial for finance.

Use cases: Smart contracts, cryptocurrency platforms, cross-border payments, secure digital identity verification.

Impact: Reduces fraud, increases trust, and supports decentralized finance (DeFi) platforms.

3. Cloud ComputingOverview: Cloud platforms provide scalability, flexibility, and cost efficiency for fintech apps.

Use cases: Mobile banking apps, digital wallets, loan platforms, data analytics, and disaster recovery.

Impact: Enables faster deployment, global accessibility, and secure storage of sensitive data.

4. Big Data AnalyticsOverview: Big data helps fintech software development companies analyze massive amounts of financial data to make smarter decisions.

Use cases: Risk assessment, customer behavior analysis, personalized product recommendations.

Impact: Improves predictive capabilities, fraud detection, and customer retention.

5. Robotic Process Automation (RPA)Overview: RPA automates repetitive, rule-based tasks in financial operations.

Use cases: Invoice processing, reconciliation, account opening, compliance reporting.

Impact: Reduces manual errors, lowers operational costs, and speeds up transaction processing.

6. Internet of Things (IoT)Overview: IoT devices can gather real-time financial data and enhance user engagement.

Use cases: Wearable payments, smart ATMs, connected banking devices, personalized financial tracking.

Impact: Provides real-time insights, improves customer engagement, and enables new revenue streams.

7. Cybersecurity & Advanced EncryptionOverview: Cybersecurity in fintech is a non-negotiable for fintech apps handling sensitive financial data.

Use cases: Multi-factor authentication, end-to-end encryption, secure transaction protocols, compliance with regulations (PCI DSS, GDPR).

Impact: Protects user data, ensures compliance, and builds trust with customers.

Also Read: Building Glocal Payment Systems: The Next Big Opportunity in FinTech

Launching a fintech mobile app without validation is risky. By conducting thorough research, testing MVPs, and ensuring compliance, you minimize risks, maximize ROI, and lay the foundation for a successful fintech app. Top fintech app development companies emphasize this approach for every project.

Proper validation ensures that your idea addresses real problems, attracts users, and complies with regulations. Experts recommend the following process:

Analyze competitors, identify underserved niches, and study user pain points. Understanding market demand reduces the chance of developing an app that fails to resonate.

Know who your users are their demographics, financial habits, and tech literacy. This guides feature prioritization and ensures the app provides meaningful value.

Develop an MVP with core features to test usability, gather data, and validate assumptions. MVPs allow startups to enter the market faster while limiting upfront investment.

Early user feedback, expert reviews, and investor insights help refine the app. Iterative improvements based on real-world data increase success chances.

Even at the validation stage, ensure your app concept aligns with KYC, AML, GDPR, and PCI-DSS regulations. Non-compliance can halt development or cause legal issues later.

Interactive prototypes help validate user flows, navigation, and overall UX before committing to full-scale development.

Identify how the app will generate revenue: subscriptions, transaction fees, in-app services, or premium features. The right model ensures profitability from the start.

Apptunix is recognised as one of the top fintech software development companies, trusted by startups and enterprises worldwide. With a proven track record in custom AI-powered fintech app development and secure mobile banking platforms, we have the best fintech app developers for enterprises. We help businesses transform their fintech ideas into scalable, reliable, and revenue-generating applications.

We build tailored digital fintech apps, payment platforms, lending solutions, and wealth management tools that meet the unique needs of startups and enterprises. Every app is designed with scalability, security, and regulatory compliance in mind. You can explore more detailed case studies on Apptunix’s portfolio here.

These examples demonstrate the company’s expertise in delivering custom fintech app development for large enterprises and AI-powered fintech app development for startups globally. Apptunix has successfully delivered numerous fintech applications across various domains, including:

Partner with Apptunix to hire fintech app developers and turn your vision into a secure, scalable, and profitable application. Whether you are a startup seeking fast deployment or an enterprise requiring complex financial workflows, Apptunix ensures your fintech solution is compliant, innovative, and ready to scale.

The fintech industry is brimming with opportunities, but transforming an idea into a successful, revenue-generating app takes more than vision. Selecting among fintech software development companies can be the difference between an app that thrives and one that struggles to gain traction.

The fintech market moves fast. Delaying your project could result in missed opportunities and increased future development costs.

Start by:

With the right team, your idea can evolve into a market-leading solution that drives revenue, fosters customer trust, and establishes your presence in the financial services sector.

Don’t leave your fintech vision to chance. Start your project with Apptunix today and transform your concept into a secure, intelligent, and scalable custom fintech app development solution that sets you apart in the market.

Q 1.What are the top fintech app development companies for startups and enterprises?

Discover leading fintech software development companies that specialize in custom fintech app development, AI-powered solutions, and mobile banking apps to support startups and large enterprises.

Q 2.What is the cost of developing a fintech app?

Fintech app development cost varies depending on features, complexity, AI integration, blockchain, and platform (iOS, Android, or web). Startups may spend $25,000–$50,000, while enterprise-grade apps can exceed $100,000.

Q 3.What are the must-have features in a fintech application?

Essential features include secure authentication, digital wallets, AI-powered analytics, regulatory compliance, multi-platform support, and customer support.

Q 4.How long does it take to build a fintech app?

Development time depends on app complexity, integrations, and custom features. A basic app can take 3–6 months, while enterprise-grade apps may take 9–12 months or more.

Q 5.Can startups afford enterprise-level fintech app development?

Yes, with affordable mobile app development companies and phased MVP strategies, startups can launch scalable fintech apps while keeping initial investment manageable.

Q 6.What technologies are used in modern fintech apps?

Modern fintech apps leverage AI, blockchain, cloud-based infrastructure, cybersecurity protocols, open banking APIs, and RegTech compliance automation.

Q 7.How do I hire fintech app developers without mistakes?

Check portfolios, tech stack, domain expertise, post-launch support, and experience with AI-powered fintech app development and custom solutions.

Q 8.Why should I choose Apptunix for fintech app development?

Apptunix offers end-to-end fintech solutions, including digital banking apps, AI-powered analytics, blockchain-based platforms, and secure payment solutions for startups and enterprises.

Q 9.What are the 7 stages of app development?

Idea Validation: Research market needs, competitors, and target audience.

Requirements Analysis: Define features, compliance requirements, and technical specifications.

UI/UX Design: Create intuitive, user-friendly interfaces and workflows.

Development: Build the frontend, backend, and integrate APIs, AI, or blockchain as needed.

Testing & QA: Conduct functional, security, and performance testing to ensure a flawless experience.

Deployment: Launch on app stores or enterprise platforms, ensuring compliance with regulations.

Maintenance & Updates: Monitor performance, fix bugs, and implement feature updates.

Q 10.Which is the fastest growing fintech market in the world?

The U.S. and UAE fintech markets are leading global growth due to high adoption of digital payments, mobile banking, and AI-powered financial services. Emerging economies in Asia-Pacific, particularly India and Singapore, are also seeing rapid fintech expansion driven by mobile penetration and digital-first policies.

Q 11.Has Apptunix delivered successful fintech projects before?

Yes, Apptunix has a global client base and has built digital wallets, payment apps, lending platforms, and mobile banking solutions that are secure, scalable, and user-friendly.

Q 12.Does Apptunix handle AI-powered fintech solutions?

Apptunix specializes in AI-driven financial apps, including fraud detection, predictive analytics, personalized investment recommendations, and AI-powered dashboards.

Q 13.How to validate a fintech app idea before development?

Conduct market research, competitor analysis, define your target audience, create an MVP, gather feedback, and ensure regulatory compliance.

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Book your free consultation with us.

Book your free consultation with us.