Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

8 Top Fintech Apps to Inspire You Build One in 2022

The year 2021 was transformative for the fintech industry. What felt like a corner of the tech world a decade earlier (which no one was taking seriously), is today the largest funded tech domain globally. This article gives you insights into the 8 top fintech apps and their working models. Read the complete article to know more.

Last year, the fintech app development company received over $130 Billion in capital, and interest in the domain grew significantly in many parts of the world.

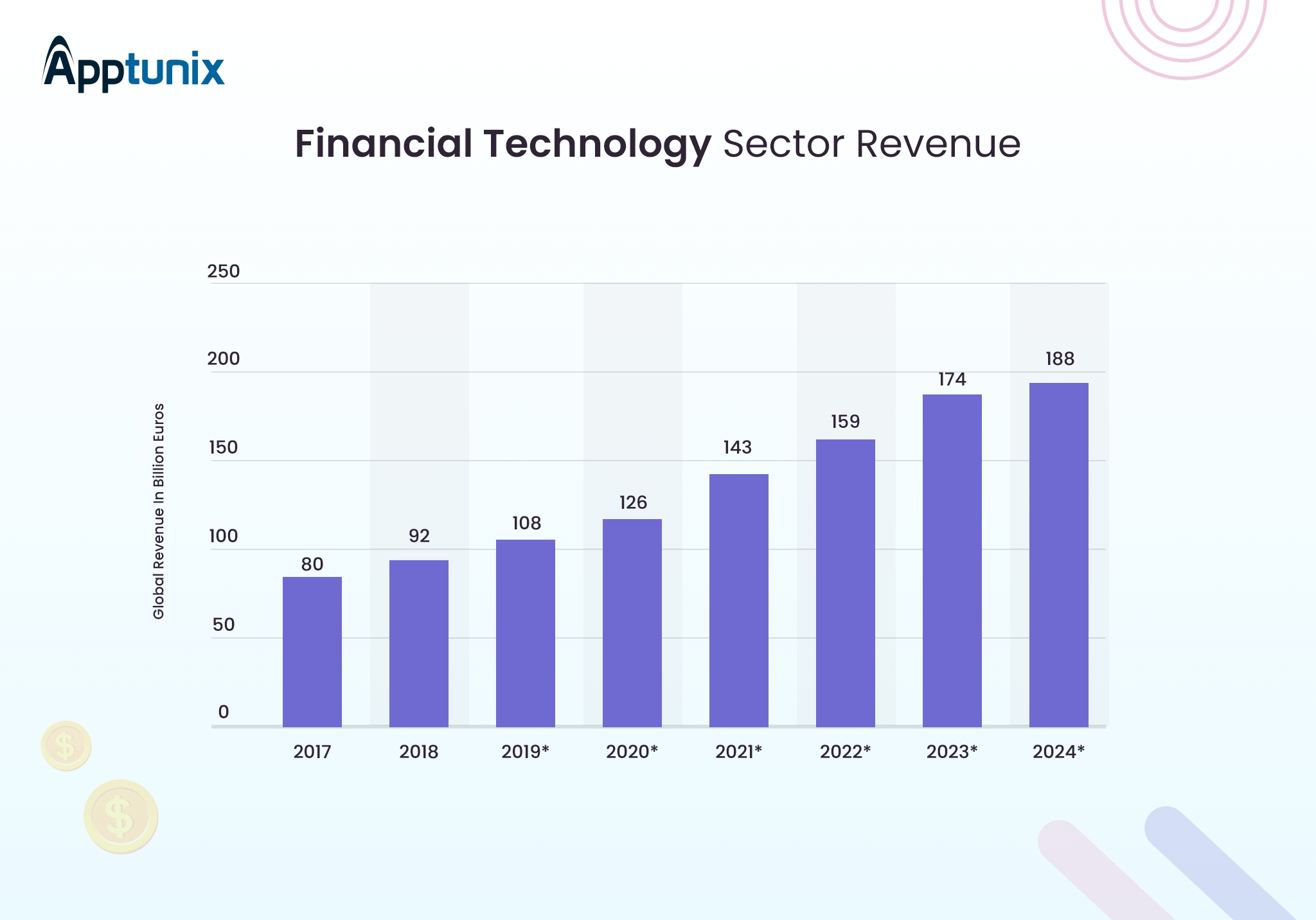

With the rise of neobanks, buy-now-pay-later, contactless payments, and more, it is not easy to say where this industry is heading but you can not neglect the potential it has to grow and bloom continuously. The sector’s revenue is expected to grow at an average rate of around 12% in the coming years and reach a value of €188 Billion by the year 2024.

Source: Statista

So, if you are someone who plans to enter the market seeing the immense growth potential with your own fintech mobile application, we got you covered.

In this article, we will list some top fintech apps that you should analyze to know how they work and make money in order to discover the most profitable and efficient business model for your own fintech startup. Because the most meaningful way to stand out in the market is to analyze what your competitors are doing and find a better way to do the same differently.

So, let’s get started.

8 Most Popular Fintech Apps in 2022

Some top fintech apps such as Robinhood, Revolut, and Coinbase are examples of fintech products and companies that are thriving globally. However, their features, business, and revenue models are completely different.

Let’s have a quick look at the same before we analyze their operations in detail:

1. Coinbase: Cryptocurrency Wallet App

Coinbase is an app that allows users to sell and buy all types of cryptocurrencies, for example, Ethereum, Bitcoin, and around 50 others. It can also be used to convert one cryptocurrency to another and for sending or receiving crypto to and from other app users.

Its business model revolves around the fee it charges for cryptocurrencies trading. Other revenue streams of Coinbase are referral fees for advertising courses, credit card transactions fees, custody services, and profits from investments. The platform was launched in 2012 and is known to be the first widely embraced cryptocurrency business.

How Does Coinbase Work?

For investors, Coinbase offers the following four products and they can choose one depending on their needs:

- Coinbase: It is a simple web and mobile app for buying, selling, and trading crypto tokens and cryptocurrencies.

- Coinbase pro: It performs the same functions but its UI is designed for professional traders, with various tools. The trading fee is also low on the pro version.

- Coinbase wallet: It is a standalone crypto wallet that allows users self-custody.

- Coinbase card: It is a visa debit card by Coinbase that lets users spend their cryptocurrency at any business that accepts Visa.

If you plan to develop a fintech product like Coinbase, here is your ultimate guide to mobile wallet app development. Find out what features you should add and how you can stand out in the market to earn billions in revenue.

2. Revolut: The Fastest Growing Neobank of the UK

Revolut is a neobank that provides several financial products to businesses and consumers. Its biggest assets are its powerful and robust mobile applications for iOS and Android. The company doesn’t own any physical branch.

Developed by two Russians having experience in the fintech sector, Revolut is today the UK’s most valuable private tech startup. The app boasts over $836 million in funding, more than 10 million users, and operates in more than 30 nations across the globe.

How Does Revolut Work?

- It lets users transfer money to other bank accounts – domestically as well as globally.

- Users can create budget plans within the app to manage funds and spending

- It has an option that automatically puts money aside for users for saving purposes

- Users can use it for trading various stocks or investing in cryptocurrencies

- It makes money by providing users a subscription service that lets them enjoy various benefits like extended customer support, a premium card for withdrawing cash without fee, and free lounge passes. and more

- The app also charges a fee on international money transfers and loans.

For more insights on How Does Revolut Work, check out our comprehensive blog on Revolut Business and Revenue Model. It lists everything from the success story of Revolut, business model canvas, revenue model, and what you can learn from its success.

3. Robinhood: One of the Best Fintech Mobile Apps

Robinhood is an online trading platform that lets customers buy and sell financial assets, such as cryptocurrencies, stocks, and exchange-traded funds. The customers do not even require to pay a brokerage commission when trading on the platform.

Headquartered in San Francisco and launched in 2013, the app has grown to become one of the top fintech applications in the industry. In 2021, it went public on the Nasdaq stock exchange. More than 70% of the company’s customers avail its services via the mobile application. But, it also provides a website, tablet, and smartphone app to engage users on different platforms.

How Does Robinhood Work?

Robinhood has a freemium business model. Its value proposition is fueled by an easy-to-use investing platform that lets even the novice trader buy and sell stocks, crypto, and other assets, all commission-free.

- Robinhood is a user-friendly platform designed for newcomers to trade swiftly and professionals to trade smartly.

- The company makes most of its revenue from the transactions placed by its customers and not by charging commissions. It calls this method Payment for Order Flow.

- It also provides a margin trading service called Robinhood Gold, which starts at $6 per month.

- The business utilizes freemium to its benefit by providing some of its services for free and charging for the advanced features and functionalities – the most successful business model in the fintech industry.

According to Crunchbase, Robinhood raised $5.6 billion in 20 rounds of funding from various investors. When the company went public in 2021, its valuation was around $32 billion and it raised another $1.9 billion in the IPO.

4. NuBank: An Online Banking App

Like Revolut, Nubank is a neobank that provides many financial products in one app, including loans, savings accounts, and more. Launched in 2013, Nubank is today one of the world’s largest neobanks with more than 40 million customers.

Customers can access its services by visiting the company’s website or downloading its mobile apps for Android or iOS. Its business model revolves around building an ecosystem of services that it can provide to its consumers on a single platform.

How does NuBank work?

The goal of most neobanks is almost the same, to provide consumers with lower interest rates and easy access to their bank accounts and Nubank is no exception. It makes money through the following streams:

- Interchange fee: When a user uses Nubank’s credit or debit card for payment, an interchange fee is charged.

- Subscriptions: Its one product is a premium card which comes at the cost of around $10 per month. Using it, customers can enjoy many benefits like free Wifi at airports, free travel insurance, and others.

- Interest on cash: Nubank, like any other traditional bank, lends cash to customers and collects interest on the amount.

- Overdraft fee: It charges a fee when a user extends the limit on his/her credit card.

Its other revenue streams are cash withdrawal fees, referral fees, and loans. As per Crunchbase, Nubank raised $2.3 billion in funding from various investors.

5. N26: One of the Top Fintech Apps for Finance Management

This fintech application is based out of Germany and lets you take complete charge of your finances after you install it. N26 provides transparent money management tools to its customers so that they can save better and spend in a wise manner.

Along with this, it lets users withdraw cash twice per month for free from ATMs. The company has been featured in Forbes, TechCrunch, and many other prestigious platforms for securing huge funding from various investors and over 60k five-star reviews worldwide.

How does N26 work?

Although traditional banks consider N26 one of their biggest threats, it operates on the same lines and revenue streams.

- The application has a legal banking license and it charges nothing for opening and using an account.

- Users can also use the app to initiate instant money transfers and manage spending by analyzing statistics.

- N26 has different subscription plans for private and business customers. It charges around €9.90 or €16.90 per month depending on the plan you choose and provides benefits like insurance and discounts at specific stores.

- Its other revenue streams are interchange fees, overdrafts, insurance commissions, cashback, and loans.

The company provides bank accounts in several countries across North America and Europe. Its competition is not just other Fintech Products but traditional banks as well.

6. MoneyLion: An Online Mobile Banking Application

MoneyLion is a private fintech organization that provides financial advisory, lending, and investment services to customers. The company’s sole goal is to help customers manage their money efficiently and boost their credit.

In the market for more than six years, MoneyLion is preferred by a number of consumers worldwide due to its easy-to-use interface and wealth management aspects.

How does MoneyLion work?

It works on a subscription-based model and lets users set up an account just like they do with a bank. Besides, it provides banking services as well.

- The app lets users transfer money immediately and charges no checking fees.

- Using it, customers can save, invest, and borrow in one place conveniently.

- It provides advantages like an effortless loan application process, cashback, checking of the credit score, push notifications of transactions, etc.

7. Chime: A Mobile Banking App

Chime is another great Fintech Product available in the market. What makes it stand among its rivals is the virtual absence of the fee, whether you’re sending the amount to other users online or withdrawing the same from its impressive network of around 40.000 ATMs.

Chime’s only mission is to make banking operations easy, helpful, and free for its consumers. The app has over 12 million customers and that makes it bigger than many fintech apps in the banking space. These account owners initiate an average of around 40 transactions each day using the mobile application.

How does Chime work?

- One of the amazing features of the Chime app is that it automatically helps its customers save money by deducting 10% of the total amount credited to their saving accounts.

- The app has no monthly or hidden fees and the deposit goes to the Chime account directly.

- It does not charge any fee on ATM withdrawal and has more than 60,000 ATMs operational all over the USA

- Chime makes most of its money by charging users interchange fees and interest on cash.

8. Mint: A Personal Finance Application

Mint is a free money management tool that has helped millions of Americans manage their budget for over a decade. One of the unique features of Mint is that it lets users access all their accounts in one place to have an overview of their financial life.

It brings together a complete overview of customers’ finances from spending, budgets, balances to investment, and credit scores. The app is free to use but makes money using Ads and partner offers.

How does Mint work?

The app has three main features, as mentioned below:

- Bill Payment Tracker: It provides users an overview of their upcoming bills and other balances in one place.

- Budgeting: After users link their bank accounts to the Mint app, it helps them analyze their spending and set budget goals personalized for them.

- Free Credit Score: Customers can check their credit score on the app for free.

Other than that, it provides notifications and alerts of transactions and other account-related activities. It generates revenue based on referrals made to products, financial institutions, or credit cards.

Wrapping Up

So, the above-mentioned are the top fintech apps that you can consider as an inspiration to build your own fintech startup in 2022. If you have an idea for a Fintech Product, you can get in touch with Fintech App Development Experts at Apptunix to build an amazing and profitable product!

Rate this article!

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Nikhil Bansal is the Founder and CEO of Apptunix, a leading Software Development Company helping startups as well as brands in streamlining their business processes with intuitive and powerful mobile apps. After working in the iOS app development industry for more than 10 years, he is now well-equipped with excellent problem-solving and decision-making techniques.

App Monetization Strategies: How to Make Money From an App?

Your app can draw revenue in many ways. All you need to figure out is suitable strategies that best fit your content, your audience, and your needs. This eGuide will put light on the same.

Download Now!Subscribe to Unlock

Exclusive Business

Insights!

And we will send you a FREE eBook on 'Mastering Business Intelligence.