How Much Does It Really Cost to Build a Fitness App Like Strava in 2026?

59 Views 2 min February 24, 2026

Nikhil Bansal is the Founder and CEO of Apptunix, a leading Software Development Company helping startups as well as brands in streamlining their business processes with intuitive and powerful mobile apps. After working in the iOS app development industry for more than 10 years, he is now well-equipped with excellent problem-solving and decision-making techniques.

They are all in your pockets. Aren’t they?

Until or unless, you are not living under a rock or above the sky, you must be using a payment app for buying goods or services.

A no-cash future may not be here completely, but in part, it’s already here because of mobile payment apps that allow us to send and receive money in real-time – no need for checkbooks or cash withdrawal from ATMs.

According to Research, the market was valued at $88.5 billion in 2024, with forecasts projecting growth to $587.5 billion by 2030—a CAGR of 38.0% between 2025 and 2030. And this is occurring as a result of the universal popularity of mobile devices that have helped certain sort of payment applications to develop rapidly.

PayPal is a great example – founded by Elon Musk and a team of enthusiasts in the 90s – the organization has developed tremendously over time and is presently the best payment application utilized by more than 200 million users around the globe.

So, what is the success mantra of these popular mobile payment apps? Can you replicate their features or business model to get something more innovative and disruptive out of it?

The answer is YES. The market of Mobile Payment Apps is large and there is enough room to grow and flourish here, even if you have a limited budget and want to accomplish something in less time.

Before getting to the answer to How much it will cost you to develop an app like PayPal, let’s find out how these apps work:

PayPal is a P2P vendor that does not rely on banks. The application utilizes its mechanism of storing money and processing transactions, with no link to any financial organization. It has the Wallet feature through which it is possible to store cash before sending in some bank account or to a friend.

PayPal’s user base, since its inception, has developed to 202 nations where around 188 million clients transact funds in more than 25 monetary forms. Have a look at How PayPal works:

1) PayPal allows users to create their very own PayPal account – easy and free.

2) Users will have to link their preferred credit, prepaid or debit cards to their PayPal account.

3) Afterward, they will get an option to pay via PayPal every time they make a purchase or send money to a friend – without entering their card details on every other platform.

PayPal work as both – a payment gateway and a merchant account. The application additionally has incredible security features including encryption, address and fraud screening and that is what makes it one of the best Mobile Payment Apps in the market.

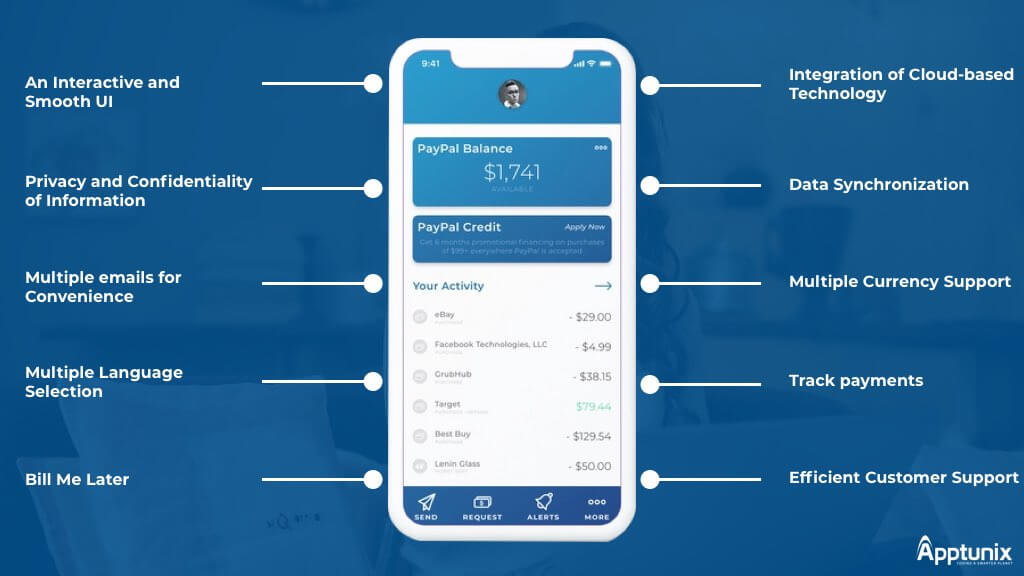

When it comes to making payments via apps like PayPal, it’s simply a matter of touch. These apps help link your debit/credit cards, with the application, and it’ll be saved afterward to perform the transaction whenever required without a problem. Here are some must-have features to consider while building up a mobile wallet application like PayPal:

1. An Interactive and Smooth User Interface

UI plays a significant role in user engagement for the mobile application. The appealing UI of PayPal encourages users in the first look. To utilize the application easily with no perplexity, it is important that the UI of the mobile wallet application must be simple to utilize, and appealing.

2. Integration of Cloud-based Technology

With this feature, speedy transactions are possible in a safe manner utilizing PayPal. The cloud-based technology provides users the full suite of functionalities to change their smartphones into digital wallets.

3. Privacy and Confidentiality of Information

While using PayPal, the information stored in a user’s bank account or credit card isn’t revealed during a transaction. Thus, privacy and confidentiality is a must-have feature for Mobile Payment Apps.

4. Data Synchronization

Digital wallet applications store your account number, credit/debit card details, and passwords in a solitary application, so you can recover your data on your smartphone phone whenever you need.

5. Multiple emails for Convenience

As an account owner, users can provide up to 8 email addresses connected to a single bank account which makes payment of money more flexible and convenient. It also serves as a shield from hackers who may get familiar with a solitary email.

6. Multiple Currency and Automated Conversion Process

Another special feature of PayPal is that it supports numerous currencies of various nations and has an automated currency conversion procedure depending on the current conversion rate. This takes out unnecessary conversion charges when withdrawing from local bank accounts.

7. Multiple Language Selection

PayPal supports more than 20 languages in its platform which makes it simple for anybody in the country approved by PayPal to register for an account without the trouble of translation from English.

8. Track payments

To provide an excellent user experience, you should give users the alternative to keep track of their financial history. Along with giving the alternative to track transaction history in the application, you should send them emails as well – monthly or weekly.

9. Bill Me Later Feature

With an end goal to make financial transactions fast and to help users who don’t have immediate cash for payment, bill me later feature was incorporated where an account holder can make the purchase even without having adequate funds in his bank account but would be charged later through his credit card. This feature is accessible to US account holders only.

10. Efficient Customer Support

PayPal has the reputation of having exceptionally fast customer support as they reply to inquiries of customers within two business days using email or phone calls immediately.

The features that we just looked at are the ones which are generally present in numerous P2P Payment apps. And, that is what makes them the must-have features of a Mobile Payment App.

Also Read: Cashback App Development – Complete Development Process With Cost

The security measures and the features that a PayPal like application needs places it in the category of high complexity apps. Presently while there are still various things that need to be considered when deciding PayPal like application development cost, it is possible to give a rough estimate based on the feature set mentioned above.

If your feature set is the same as the one mentioned above, the answer to what is the cost to make an application like PayPal will come down to something like USD 10-40K. Even though the range is on the higher end, as the application’s complexity demands, it can further come down or go higher from the specified cost.

Most Recommended: How Much Does it Cost to Build a Mobile App?

The demand for Mobile Payment Apps is increasing day by day – not only entrepreneurs and business persons are using them but millennials have also developed a craze of using these apps with time. Now that you know the crucial features and cost of developing an app like PayPal, don’t waste time anymore. Let’s create wonders together. Get in touch.

Bonus Read: True Fintech App Development Cost: Hidden Fees Unveiled

Q 1.Why should businesses invest in developing a mobile payment app like PayPal?

With the global shift toward digital transactions, having a custom mobile payment app enhances customer convenience, builds brand loyalty, and opens new revenue channels. It positions your business as tech-savvy, competitive, and ready to meet modern consumer expectations.

Q 2.Can I develop a mobile payment app like PayPal on a limited budget?

Yes, starting with a Minimum Viable Product (MVP) is a smart approach if you have budget constraints. You can launch with core features like user registration, wallet integration, and secure transactions, and gradually add advanced features as your app gains traction.

Q 3.What makes PayPal stand out from other mobile payment apps?

PayPal’s success comes from its strong global presence, robust security infrastructure, seamless multi-currency support, and trust built over decades. Its ability to work as both a digital wallet and a payment gateway adds flexibility for users and merchants alike.

Q 4.How important is compliance with financial regulations in mobile payment app development?

Extremely important. Payment apps handle sensitive financial data, so compliance with regional and international standards like PCI-DSS, GDPR, and AML (Anti-Money Laundering) regulations is mandatory. It ensures legal operation, builds user trust, and safeguards against penalties.

Q 5.Do I need a team of developers to build an app like PayPal, or can I hire an agency?

While building an in-house team is an option, partnering with an experienced mobile app development company is often more efficient. Agencies bring expertise in fintech app development, security protocols, and industry compliance—all under one roof—helping you launch faster and more securely.

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Book your free consultation with us.

Book your free consultation with us.